Unsurprisingly, the coronavirus is the primary reason for the quarter-to-quarter jump in the seasonally adjusted mortgage delinquency rate, according to the Mortgage Bankers Association.

"The mortgage delinquency rate in the fourth quarter of 2019 was at its lowest rate since MBA's survey began in 1979," Marina Walsh, vice president of industry analysis, said in a press release. "Fast-forward to the end of March, and it is clear the COVID-19 pandemic is impacting homeowners. Mortgage delinquencies jumped by 59 basis points, which is reminiscent of the hurricane-related,

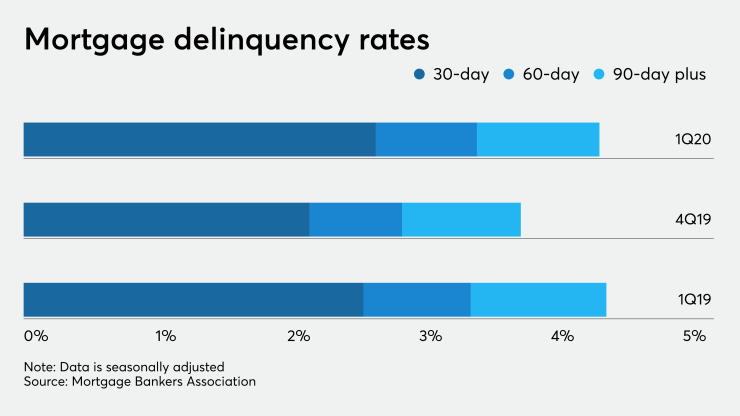

Total past due rate was 4.36% on a seasonally adjusted basis, compared with 3.77%

There was a quarter-to-quarter surge in 30-day late borrowers as of March 31 (up 50 bps to 2.67%), with much smaller gains of borrowers 60 days late (a 7-basis-point rise to 0.77%) and 90 days or more late (up 3 bps to 0.93%) compared with the fourth quarter last year.

The 30-day past due rates for conventional loans increased 30 bps in March, but for Federal Housing Administration-insured mortgages it rose 113 bps and for Veterans Affairs-guaranteed loans, the rate was up 78 bps.

The total FHA delinquency rate increased by 131 bps to 9.69%, the highest level since the fourth quarter of 2017. At the same time, there was a 101-basis-point rise in the VA delinquency to 4.65%, the highest since the first quarter of 2015.

Foreclosure starts are likely to be flat in future surveys given the foreclosure moratoria and borrower forbearance guidelines under

But the number of loans going into default will continue to rise, since borrowers on forbearance plans are reported as delinquent if the payment was not made based on the original terms of the mortgage, which is similar to how it collects data from natural disasters.

About 7.91% of all

"Once foreclosure moratoria are lifted and forbearance periods end, borrower repayment and modification options, combined with year-over-year equity accumulation and home-price gains, may present alternatives to foreclosure for the millions of distressed homeowners affected by this unfortunate pandemic and economic crisis," Walsh said.

Foreclosure starts were down 4 bps on a seasonally adjusted basis to 0.19% and 2 bps unadjusted from the fourth quarter to 0.18%. Starts were down 4 bps both adjusted and unadjusted from the first quarter last year.

The unadjusted foreclosure inventory rate of 0.73% was 5 bps lower compared with the fourth quarter and 19 bps lower on a year-over-year basis.

"Mortgage delinquencies track closely with the U.S. job market," said Walsh. "With unemployment rising from historical lows in early 2020 to