The three major hurricanes that caused so much devastation during August and September was largely responsible for the third-quarter increase in mortgage delinquencies.

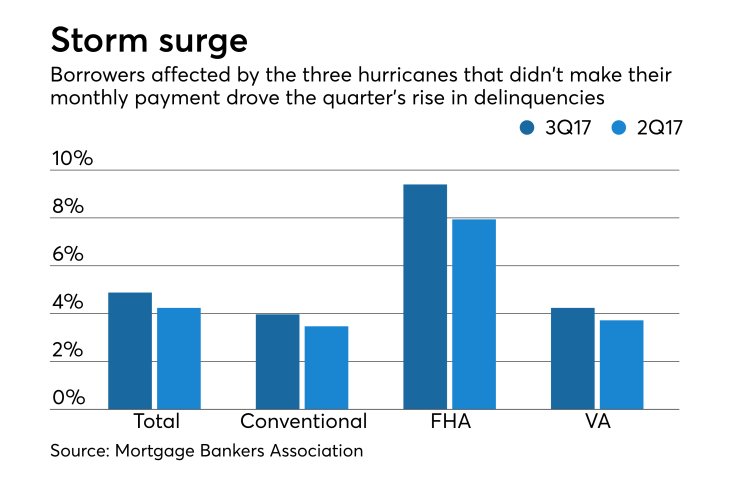

The seasonally adjusted delinquency rate of 4.88% was 64 basis points higher than the second quarter, according to the Mortgage Bankers Association's National Delinquency Survey. The 30-day delinquency rate was responsible for 50 basis points of that increase, said Marina Walsh, the MBA's vice president of industry analysis, in a press release.

Compared with one year ago, delinquencies were 36 basis points higher.

Federal Housing Administration-insured mortgages had a 146-basis-point increase in

There was a 52-basis-point increase in Veterans Affairs mortgage delinquencies to 4.24%, while the conventional loan delinquency rate rose 50 basis points to 3.97%.

"While the storms played a critical factor in explaining the rise in the overall delinquency rate, there are other factors to consider, especially given delinquency rate increases in other states not directly impacted by the storms," she said.

"First, there were timing issues associated with the last day of the month being a Saturday. Processing for mortgage payments made over the weekend did not occur until Monday, Oct. 2 and thus these mortgage payments were identified as 30-days delinquent per NDS definitions."

Plus, delinquency rates were at historic lows in the second quarter. The FHA delinquency rate was at its lowest point in 21 years, while for the VA, late payments were at a level not seen since 1979.

"Foreclosure starts were down 1 basis point from the previous quarter," Walsh said. "In future surveys, we may see a temporary drop in foreclosure starts in hurricane-impacted states due to storm-related foreclosure moratoria, as was seen during Hurricane Katrina in 2005.

"It will likely take about three or four more quarters for the effects of the most recent hurricanes on the survey results to dissipate."