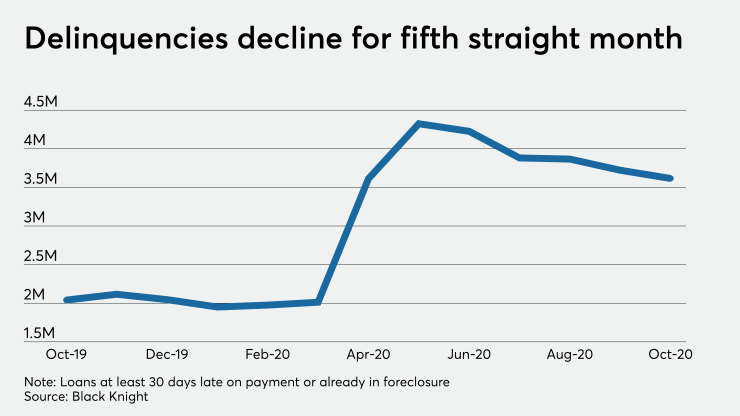

In October, mortgage delinquencies dropped to the lowest level since March but they're still much higher than pre-coronavirus rates, especially at the seriously delinquent level, according to Black Knight.

Loans at least 30 days late on their payment or already in foreclosure at the end of October descended to under 3.62 million from 3.72 million in September. While this marks the fifth consecutive month of decreases, the rate is a steep increase from the 2.04 million logged

The delinquency rate — which does not include loans in foreclosure — fell to 6.44% from 6.66% the month prior but nearly doubled the year-ago rate of 3.39%.

Seriously delinquent borrowers — those late on their payments for 90 days or more but not yet in foreclosure — also decreased monthly, to 2.26 million from 2.32 million, but significantly rose from 433,000 year-over-year.

While its rate is improving, Mississippi continues to have the highest share of noncurrent mortgages — both delinquencies and foreclosures — at the state level, at 11.29%. Shares of 11.04% in Louisiana and 9.55% in Hawaii followed. Idaho boasted the lowest at 3.52%, with 4.08% in Washington and 4.24% in Colorado just behind.

Pandemic moratoriums have helped to keep the distressed numbers in check and foreclosures at the lowest point since Black Knight began recording this metric in 2000. Properties in active foreclosure inched down to 178,000 in October from 181,000 in September and 255,000 in October 2019.

The total foreclosure presale inventory rate decreased to 0.33% from 0.34% month-over-month and 0.48% year-over-year. Foreclosure starts, however, grew to a total of 4,700, up from September's 4,500 and down from last year's 43,900.

Because interest rates kept dropping to