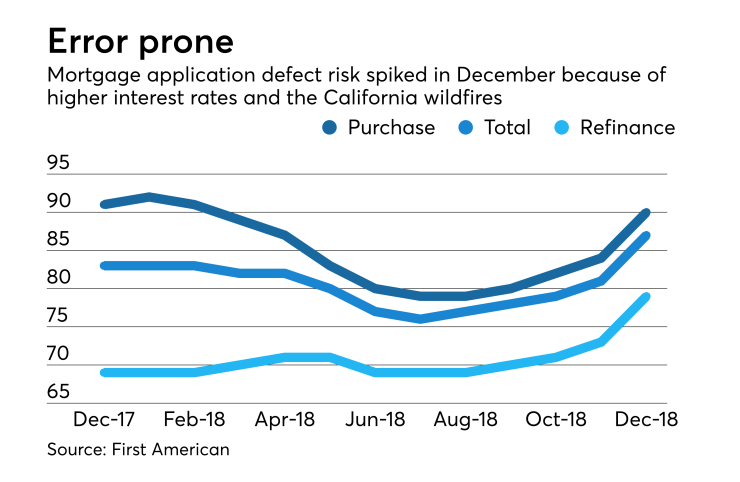

Mortgage application defect risk was at its highest level in four years because of higher interest rates as well as natural disasters during the latter part of 2018, according to First American.

But for 2019, a reduction in application defects is likely as the market shifts to adjustable-rate mortgages and California recovers from last year's wildfires.

The First American Loan Application Defect Index was 87 in December, up 7.4%

The refinance component was up 8.2% over November and the purchase segment was up 7.1%. But it is the rise in the purchase index that is more concerning to First American Chief Economist Mark Fleming.

"While loan application defects can happen on either purchase or refinance transactions, there is a greater propensity for fraud and misrepresentation with purchase transactions," Fleming said in a press release. "We have seen this before, in 2013, as mortgage rates increased, so did overall defect, fraud and misrepresentation risk."

The highest all-time index value was recorded in October 2013 at 102.

There was an increase in defects in mortgage applications from every state in December compared with November, and with 39 states on a year-over-year basis.

The

"Before July, defect, fraud and misrepresentation risk was declining in California. Since July, California's defect risk has steadily increased. In California, fraud risk was 14.5% higher than one year ago, and 6% higher than November," Fleming said.

Higher

ARMs "have been modestly less risky throughout much of 2017 and 2018," Fleming said. "If mortgage rates continue to trend up into 2019, a corresponding increase in the share of ARMs could help offset the rise in risk from the increasing share of purchase transactions."

In addition, five months after the 2017 California wildfires, defect risk started to trend downward again. A similar pattern is expected during 2019.