Better consumer credit quality helped push the serious mortgage delinquency rate to its lowest level since the Great Recession, but originations remain low due to a combination of tighter underwriting standards and eroding homebuyer affordability, according to TransUnion.

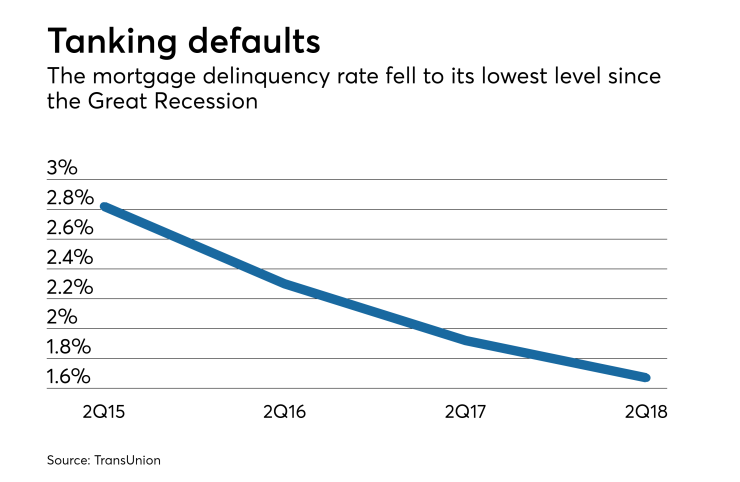

The serious mortgage delinquency rate fell 25 basis points to 1.67% in the second quarter from a year ago, while mortgage originations declined by 0.6%. The 30-year mortgage rate shot up 14% during this same time frame, making it a likely contributor to falling origination volumes, at a time when home price appreciation also created financial hurdles for homebuyers.

A shift in lender strategy since the crisis also kept mortgage originations down; the subprime share of mortgage originations fell by nearly half since 2008 and product offerings also changed, which may have helped develop a less risky population of borrowers.

"The proliferation of subprime mortgage lending in the mid-2000s, among other market factors, led to massive increases in the percentage of borrowers 60+ days past due. The metric, which traditionally had hovered around 2%, spiked to nearly 4% by Q2 2008 and peaked at over 7% in Q1 2010. Following the crisis, the tightening of lending standards has helped push the delinquency rate to much-improved levels," according to TransUnion's Industry Insights Report.

About 52% of scorable consumers had VantageScore 3.0 and credit scores of 661 and above, which most lenders consider prime or above, in the second quarter of 2008. This share jumped to 60% in this year's second quarter.

Like originations, the homeownership rate has also declined, holding steady at 64.2% since 3Q17 after hitting 70% at the beginning of the decade.