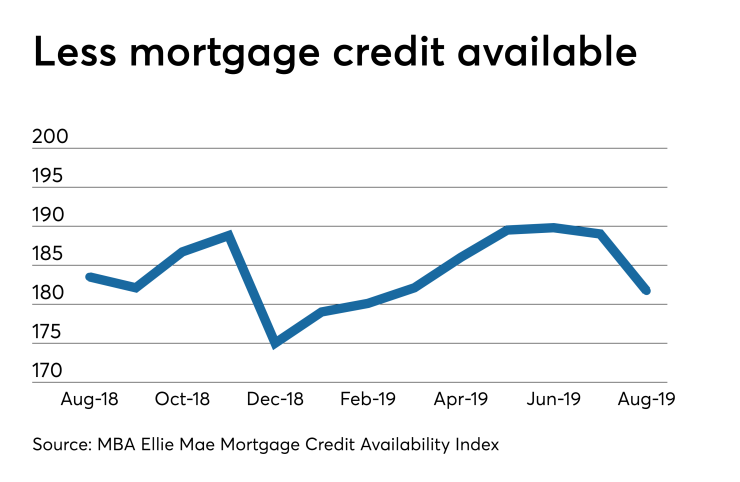

Mortgage credit availability tightened in August by the most since the end of last year, even though falling interest rates sparked a strong

The MCAI fell 3.9% to 181.7 in August from

"Credit supply declined across the board in August, even as mortgage rates fell and application activity picked up, particularly for refinances," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Last month's decrease was the largest since

It is likely lenders will continue to tighten their mortgage credit offerings in the months ahead, he added.

"We anticipate some weakening of the job market in the year ahead as economic growth cools. It's possible some lenders may be tightening credit in expectation of a slowdown," Kan said.

An unusual downtick in the conventional market may reflect that thinking.

The conventional MCAI decreased 3.6% from July and its jumbo component fell by 3.2%, while the conforming portion on the index fell by 4.3%. Meanwhile, the government MCAI decreased by 4.1%.

Except for that December 2018 drop, the conventional MCAI had trending upwards since the start of 2014 and even with last month's decline remains well above that low point.

On the other hand, the government MCAI has edged downward since 2017, showing tightening in lenders' Federal Housing Administration, Veterans Affairs and U.S. Department of Agriculture product offerings.

The MCAI is calculated by the MBA using loan program data