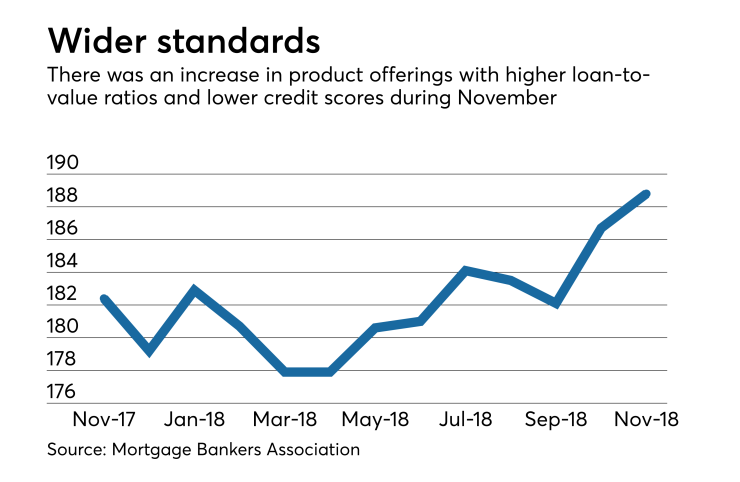

Mortgage credit available to consumers increased in November by 1.1% from the previous month as lenders offered more conventional products with expanded underwriting criteria, the Mortgage Bankers Association said.

The MBA's Mortgage Credit Availability Index rose to 188.8 from

"There were more mortgage programs offered with high loan-to-value ratios and low credit score characteristics — likely attributable to rising demand from first-time buyers," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "As seen in our weekly mortgage applications survey, average purchase loan amounts have moved lower in the second half of the year, which also supports first-timers' increased presence in the market."

The MCAI's conventional component increased by 2.4%, with the conforming portion up 4% and the jumbo segment 1.1% higher.

"As seen in our

But while more conventional products are coming to the marketplace, lender availability of government-guaranteed products, whose low down payment requirements appeal to many first-time buyers, continued to lag. The government credit availability index was down 0.1% from October, continuing the long-term trend that started in April 2017.

The MCAI is calculated by the MBA using loan program data from Ellie Mae's AllRegs Market Clarity database with a benchmark of 100 in March 2012. A lower index value indicates lenders are tightening their credit standards.

Even as the current index established a new post-crisis high, it is still far below the values established using historical data for mortgage credit availability during the boom period that ended in 2006.