Want unlimited access to top ideas and insights?

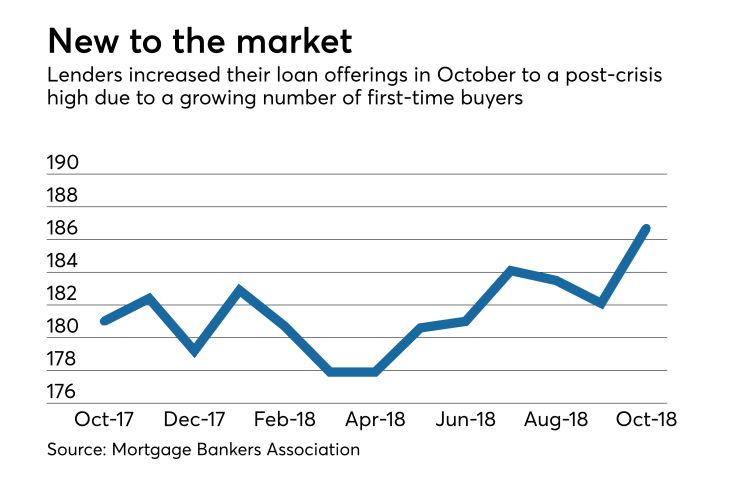

The amount of mortgage credit available to consumers increased to a post-crisis high in October in reaction to more first-time homebuyers entering the market, the Mortgage Bankers Association said.

The MBA's Mortgage Credit Availability Index increased 2.5% to 186.7 from

"Reversing a trend from last month, lenders made more conventional and low down payment programs available to prospective borrowers," Joel Kan, the MBA’s assistant vice president of economic and industry forecasting, said in a press release. "This increase in supply was likely in response to a growing number of first-time homebuyers in the market, as home price appreciation has slowed and wage growth has picked up. Jumbo credit availability also expanded last month, with the jumbo index increasing again to its highest level since the survey began."

The MCAI's conventional component was up 5.5% from September. Within the conventional index are the conforming index, which was up 4.6%, and the jumbo index, which rose by 6.3%.

However, the availability of government-guaranteed mortgage products continued its decline, falling by 0.4% from the previous month. This continues a long-term trend for government products that started in April 2017.

The MCAI is calculated by the MBA using loan program data from Ellie Mae's AllRegs Market Clarity database with a benchmark of 100 in March 2012. A lower index value indicates lenders are tightening their credit standards.

Even as the current index established a new post-crisis high, it is still far below the values established using historical data for mortgage credit availability during the boom period that ended in 2006.