The jumbo loan market tightened a little compared to the previous month, contributing to an overall contraction in mortgage credit availability, but credit availability is better than a year ago.

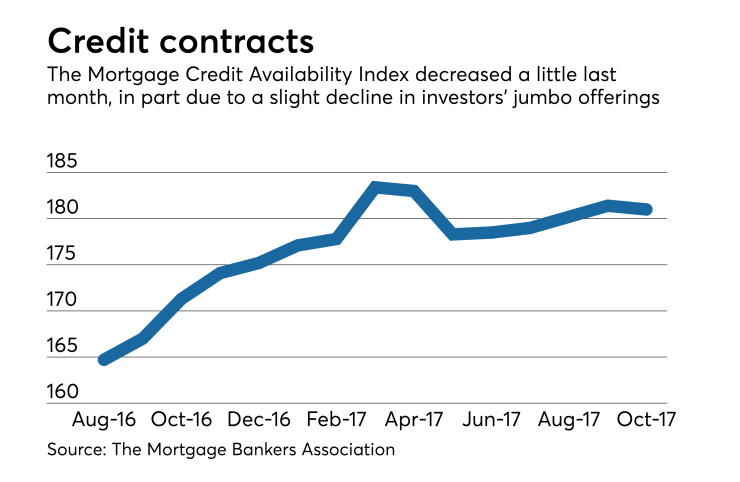

The Mortgage Bankers Association's credit availability index fell by 0.2% to 181 in October from September, led by a 2% decline in the jumbo sector. But credit availability is up from last October when the index reading was 171.3.

Compared to the previous month, credit availability in the conventional sector declined 1%. However, consecutive-month credit availability inched up by 0.3% in the government sector and by 0.2% in the conforming sector.

"While government and conforming credit programs saw slight increases in availability in October, a moderate decrease in the number of investor jumbo offerings resulted in a decrease in the total index," Lynn Fisher, the MBA's vice president of research and economics, said in a press release.

"Credit availability decreased only slightly in October and has been relatively flat for the year to date," she noted.

In September, the Mortgage Credit Availability Index was up slightly with

Overall credit availability for this year peaked at 183.4 in March following

Credit availability has been increasing only modestly in the non-jumbo space but had been increasingly significantly in the jumbo sector prior to the pullback last month.

The index measures credit availability from a baseline of 100 in March 2012. The MBA last revised the credit availability index in August of last year.