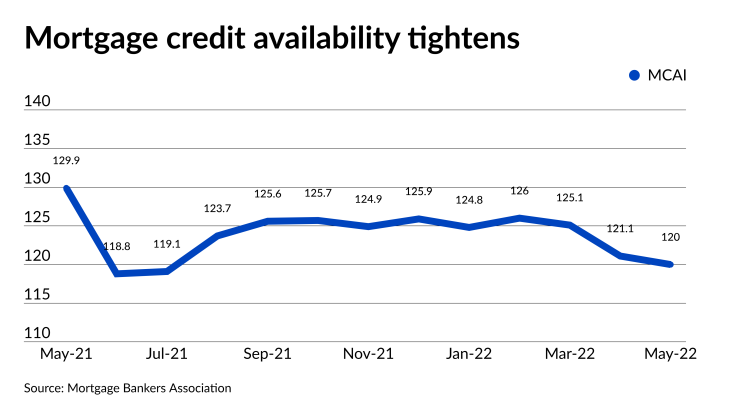

Mortgage product availability tightened for the third consecutive month, falling to its lowest level since last July, the Mortgage Bankers Association said.

May's Mortgage Credit Availability Index of 120 was down from 121.1 in April and

Government and jumbo mortgage programs were particularly affected by originators' decision to reduce offerings.

"The decrease in government credit was driven mainly by a reduction in streamline refinance programs, as mortgage rates increased sharply through May, slowing refinance activity," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Jumbo credit availability, which was starting to see a more meaningful recovery from 2020's pullback, declined after three months of expansion."

This past week, the MBA's Market Composite Index, which measures loan application activity, was at its

Jumbo demand, even with the reduction in credit availability in May, has been benefiting from an inversion in rates, as these loans remain cheaper than 30-year fixed-rate conforming mortgages. Last week's rates for jumbos was 4.99%, versus 5.4% for conforming balance loans.

The 0.9% decrease in credit availability on a month-to-month basis in May followed a much larger 3.2% drop between March and April. That prior decline was attributed to rising interest rates but was partially offset by a loosening of jumbo credit criteria.

The government MCAI, measuring the availability of Federal Housing Administration, Veterans Affairs and U.S. Department of Agriculture Rural Housing Service programs, fell by 1.3% in May, on the heels of a 6.5% decline in April.

But the conventional index was down by only 0.4%, because conforming program availability increased for the second month in a row.

The conforming portion rose by 1% in May, after a 1.2% gain in April. On the other hand, May's jumbo credit availability dropped by 1.1% after April's 0.3% increase.