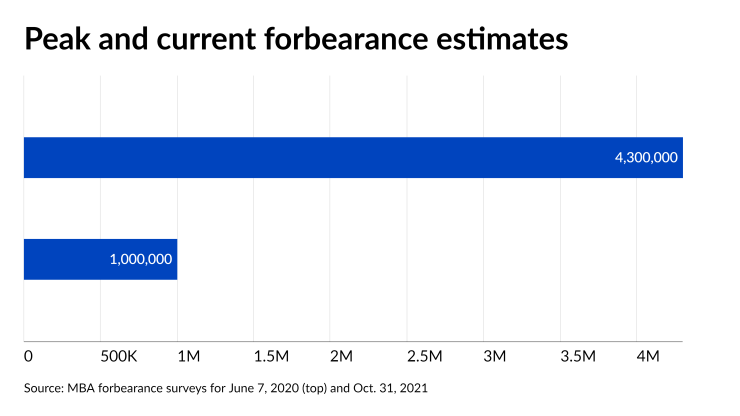

Loans with pandemic-related payment suspensions are close to falling below 1 million, down from a peak of 4.3 million in June 2020, according to the Mortgage Bankers Association.

The latest report, which is current as of Oct. 31, will be followed by the discontinuation of the group’s weekly forbearance survey. The trade group will replace it with a monthly loan performance measure starting in December.

“One million homeowners remained in forbearance as we reached the end of October, but the forbearance share continued to decline,” said Mike Fratantoni, senior vice president and chief economist at the MBA, in a press release.

Overall, the forbearance rate dropped to 2.06% from 2.15% in the most recent week. For loans purchased by government-sponsored enterprises Fannie Mae and Freddie Mac, it fell to 0.92% from 0.97%. Securitized Ginnie Mae loans in forbearance fell 13 basis points to 2.52%. The forbearance rate for private mortgages, which weren’t subject to the same restrictions as government-related programs, declined by 13 basis points to 5%.

The MBA plans to place more focus on the

“More borrowers who exited forbearance the last week of October went into modifications, a sign that they have not yet regained their pre-pandemic level of income,” said Fratantoni.

On a cumulative basis since June 2020, the share of modified loans has remained relatively unchanged near 13%, but it did rise slightly to 13.4% in the latest week. During the week ended Oct. 31, nearly 43% of outcomes were modifications, up from almost 26% the period ended Oct. 24.

However,

“The strong job market report from October, with another drop in the unemployment rate and a pickup in wage growth, is a positive sign for homeowners still struggling to get back on their feet,” he said.