Lower

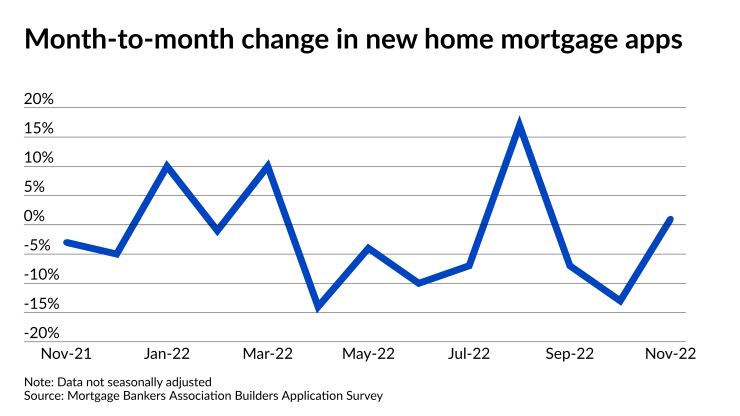

Its builder application survey for November was up 1%

"New home purchase applications recovered slightly in November, as mortgage rates retreated from their October highs and brought some prospective buyers back into a market that still faces affordability challenges," said Joel Kan, the MBA's deputy chief economist, in a press release. "Similarly, estimated new home sales for November saw an annual pace of 660,000 units — a 10% increase from October."

Meanwhile, November's residential starts data, also released on Dec. 20,

"The Federal Reserve faces a catch-22 when it comes to the housing market," Odeta Kushi, deputy chief economist at First American Financial, said in a comment on the housing starts data. "Higher rates have reduced affordability and prompted a rapid pullback in demand, but the pullback in demand has also caused builders to halt production of new homes."

December's National Association of Home Builders/Wells Fargo sentiment survey

The MBA, using builder application survey data, estimated November's new home sales ran at a seasonally adjusted annual rate of 660,000 units, an increase of 10.4% from October's 598,000 units. Unadjusted data estimated 49,000 new home sales in November, up 4.3% from 47,000 the prior month.

Over two-thirds of November's new home buyers, 67.6% applied for a conventional mortgage. Another 21.3% sought Federal Housing Administration financing, 10.9% opted for a Veterans Affairs loan and 0.2% sought U.S. Department of Agriculture Rural Housing Service funding.

"Reflecting the slowdown at the upper end of the market, the average loan size on new home purchase applications was $392,465, the lowest since June 2021," Kan said. That is down from $400,616 in October.