Mortgage applications increased 1.7% from one week earlier as the average rate for the 30-year fixed loan fell to yet another low point, according to the Mortgage Bankers Association.

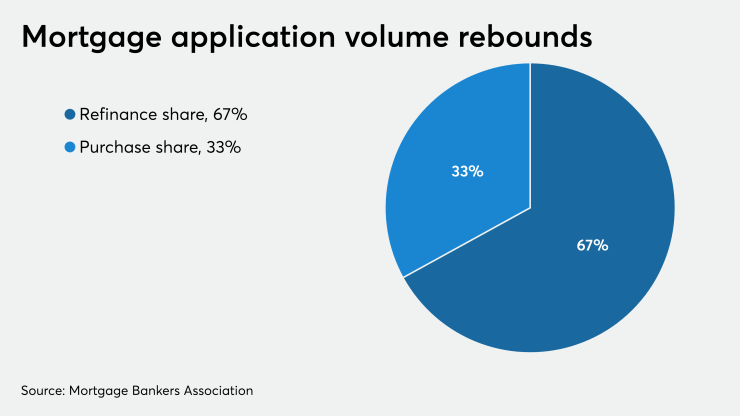

The MBA's Weekly Mortgage Applications Survey for the week ending Oct. 23 found that the refinance index increased 3%

"Refinance activity has been somewhat volatile over the past few months," Joel Kan, the MBA's associative vice president of economic and industry forecasting, said in a press release. "With the 30-year fixed rate at MBA's all-time survey low of 3%, conventional refinances rose 5%. However, the government refinance index decreased for the first time in a month, driven by a slowdown in VA refinance activity."

Purchase application volume was little changed compared with last week as the seasonally adjusted index increased 0.2%, while on an unadjusted basis it decreased 0.3%.

"Mortgage applications to buy a home were flat compared to the prior week, but overall activity remains strong this fall. Applications jumped 24% compared to last year, and the average loan size reached another record high at $372,600," Kan said.

"These results highlight just how strong the upper end of the market is right now, with outsized growth rates in the higher loan size categories. Furthermore, housing inventory shortages have pushed national home prices considerably higher on an annual basis."

Adjustable-rate mortgage activity increased to 2.1% from 1.9% of total applications, while the share of Federal Housing Administration-insured loan applications decreased to 11.7% from 11.8% the week prior.

However, there was a big drop in the share of Veterans Affairs-guaranteed loan applications, to 11.4% from 12.6%. The U.S. Department of Agriculture/Rural Development share remained unchanged at 0.5%.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased 2 basis points to 3%. Meanwhile, the 30-year FRM with jumbo loan balances (greater than $510,400) had a 5-basis-point drop in the average contract rate to 3.28%. The 15-year FRM average decreased 1 basis point to 2.6%.

But the average contract interest rate for 30-year FRMs insured by the FHA increased 2 bps to 3.14%. And the average contract interest rate for 5/1 ARMs increased by 19 bps to 3.05% from 2.86%.