Mortgage application volumes swung higher for the first time in eight weeks, buoyed by lower interest rates that led to a pickup in purchases, according to the latest data from the Mortgage Bankers Association.

The MBA's Market Composite Index, a measure of weekly application volume based on surveys of association members, climbed 2.7% higher on a seasonally adjusted basis for the seven days ending Nov. 11. Compared to the same weekly period in 2021, activity came in 68% lower.

"Application activity, adjusted to account for the Veterans Day holiday, increased in response to the drop in rates," said Joel Kan, MBA's vice president and deputy chief economist. The conforming 30-year rates saw its largest fall since July, he noted.

But the uptick in new business was limited to the purchase market. The seasonally adjusted Purchase Index, headed upward for a

"Purchase applications increased for all loan types, and the average purchase loan

dipped to its smallest amount since January 2021," Kan said.

Another drop in the Refinance Index tempered purchase gains, though. Activity for that product type "remained depressed," Kan said, pulling back 2% from the prior week. Volumes are now 88% lower from the same period last year, and refinances last week also represented just 27.6% of all applications, down from 28.1% seven days earlier. According to the MBA, lenders have

Average loan sizes shrank, not just for purchases, but refinances as well, accompanying the drop in rates. The average purchase amount decreased 3.4% to $389,400 after coming in at $403,300 seven days earlier. The diminishing average loan size, along with the slow return of purchase activity, coincides with

Likewise, the mean refinance-loan size slipped 3.7% week over week to $267,600 from $277,900. The average amount across all applications last week was $355,700, a 3.4% drop from $368,100 seven days earlier.

Meanwhile, with interest rates easing, the share of adjustable-rate mortgages relative to overall volume also backed down to 10.6% from 12% the previous week.

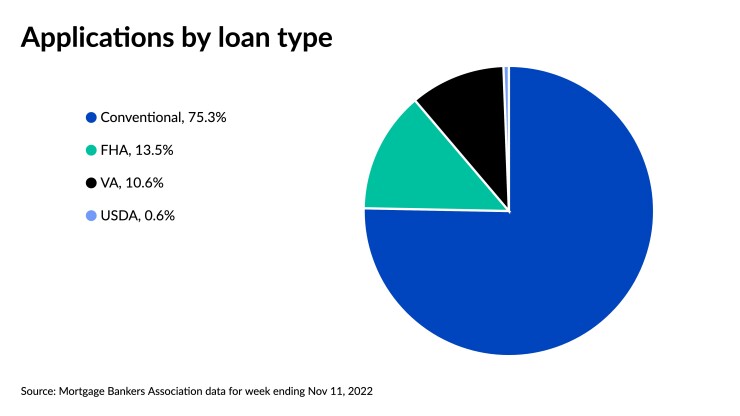

Rising in tandem with the overall composite index, federally backed mortgage activity jumped higher, with increases reported in both purchases and refinances. The seasonally adjusted Government Index rose 4.9%, while the share of applications coming through government-guaranteed programs also grew from the previous week.

Whether the weekly turnaround in activity continues will be highly dependent on the upcoming direction of mortgage rates, which saw a large decrease for the most popular 30-year conforming loan, but MBA members reported that other categories saw rates moving in a variety of directions.

The average contract rate for 30-year fixed mortgages with conforming balances of $647,200 or less dropped 24 basis points to 6.9% from 7.14% the previous week. Points decreased to 0.56 from 0.77 for 80% loan-to-value ratio loans.

Meanwhile, the contract interest rate average for 30-year fixed jumbo mortgages with balances exceeding the conforming amount edged up by a basis point to 6.51% from 6.5%, with points decreasing to 0.64 from 0.78.