Want unlimited access to top ideas and insights?

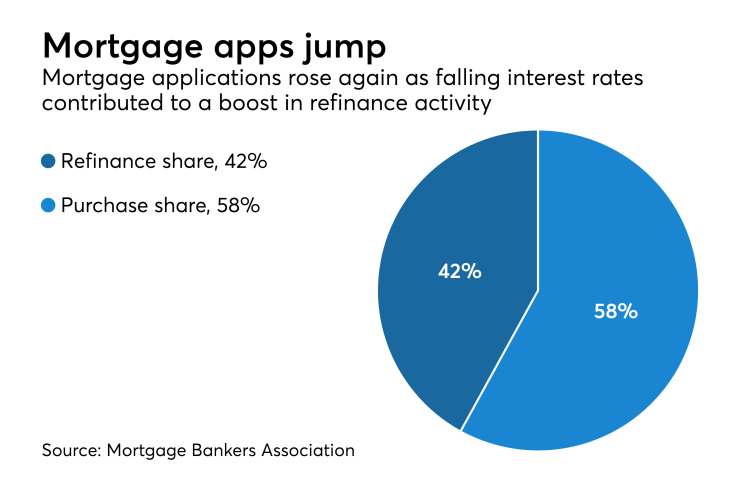

Mortgage applications rose 1.6% from one week earlier as falling interest rates contributed to a boost in refinance activity, according to the Mortgage Bankers Association.

"The 30-year fixed mortgage rate decreased 12 basis points over the week back below 5%, representing the largest single week drop since 2017," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

The MBA's Weekly Mortgage Applications Survey for the week ending Dec. 7 found that the refinance index increased 2%

The refinance share of mortgage activity increased to 41.5% of total applications, the highest level since March 2018, from 40.4% the previous week.

The seasonally adjusted purchase index increased 3% from one week earlier, while the unadjusted purchase index decreased 2% compared with the previous week and was 4% higher than the same week one year ago.

Mortgage rates fell across the board last week, as trade fears

"As a result of these recent rate declines, we saw another weekly increase in refinance applications, along with a rise in the average refinance loan size," he continued. "Larger loans tend to react more readily for a given change in mortgage rates."

Adjustable-rate loan activity increased to 7.6% from 7.4% of total applications, while the share of Federal Housing Administration-guaranteed loans increased to 10.8% from 10.2% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 10.2% from 10% and the U.S. Department of Agriculture/Rural Development share increased to 0.7% from 0.6% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($453,100 or less) decreased to 4.96% from 5.08%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $453,100), the average contract rate decreased to 4.8% from 4.89%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased to 4.97% from 5.05%. For 15-year fixed-rate mortgages, the average decreased to 4.41% from 4.5%.

The average contract interest rate for 5/1 ARMs decreased to 4.24% from 4.33%.