Mortgage applications fell for the third consecutive week, likely because those borrowers motivated to refinance have already done so, according to the Mortgage Bankers Association.

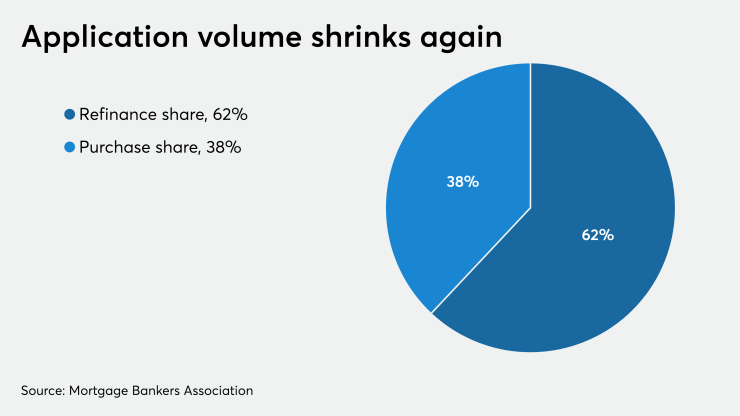

The MBA's Weekly Mortgage Applications Survey for the week ending Aug. 28 found that overall volume was down 2% and the refinance index decreased 3%

"Both conventional and government refinancing activity decreased last week, despite 30-year fixed and 15-year fixed mortgage rates declining to near historical lows," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. "Mortgage rates have remained below 3.5% for five months now, and it's possible that refinance demand may be slowing and will not significantly increase again without another notable drop in rates."

The seasonally adjusted purchase index decreased 0.2% from one week earlier, while the unadjusted purchase index decreased 3% compared with the previous week.

"Purchase applications were essentially unchanged over the week and were 28% higher than a year ago — the 15th straight week of year-over-year increases," Kan noted. "Lenders are reporting that the

Adjustable-rate mortgage activity remained unchanged at 2.6% of total applications, while the share of Federal Housing Administration-insured loan applications decreased to 10.2% from 10.5% the week prior.

The share of applications for Veterans Affairs-guaranteed loans decreased to 11.4% from 11.8% and the U.S. Department of Agriculture/Rural Development share remained unchanged from 0.6% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased 3 basis points to 3.08%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate remained unchanged at 3.41%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased 3 basis points to 3.19%. For 15-year fixed-rate mortgages, the average decreased 3 basis points to 2.67%. The average contract interest rate for 5/1 ARMs decreased 6 basis points to 3.08%.