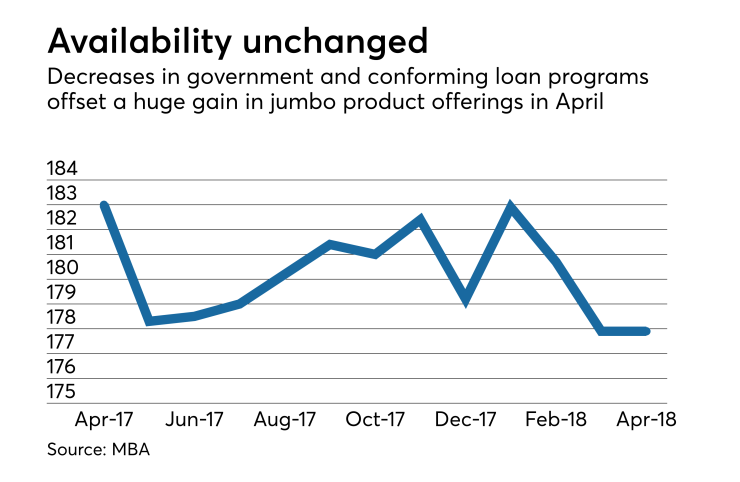

Mortgage credit availability was unchanged in April, as originators tightened their government lending programs but made more jumbo offerings available.

The Mortgage Credit Availability Index was 177.9 for April, the same as it was

This index is calculated by the MBA using loan program data in Ellie Mae's AllRegs Market Clarity database.

"Credit availability in April was unchanged overall, but the components told different stories," Joel Kan, MBA associate vice president of economic and industry forecasting, said in a press release. "Government credit tightened slightly as investors continued to pull back on streamline refinance products, while conventional credit availability increased, driven mainly by an expansion in jumbo credit."

The government loan component of the MCAI fell by 1.4% from March, while the conventional index increased by 1.9%. The conventional index is broken down into jumbo and conforming segments. The jumbo index increased by 4.4% while the conforming index declined by 0.9%.

"The jumbo market remains competitive for lenders according to data from our

The average contract interest rate for a jumbo loan in last week's survey was 4.69%, while for a 30-year conforming mortgage (which the MBA defines as one with a balance of $453,100 or lower), the rate was 4.8%.