The Western states are the most likely to experience an increase in distressed loan activity in the second half of 2019, a survey of mortgage servicers by Auction.com found.

The West was identified as the region most prone to a rise in distressed mortgages by 40% of the respondents to the survey conducted at Auction.com's Disposition Summit. The percentages of respondents who identified other regions as more likely to show signs of increased distress by the second half of the year were as follows: the Midwest, 23%, the Northeast, 20%, and the South, 17%.

"These forward-looking sentiments represent somewhat of a shift from trends seen early in the year," Auction.com said in its report.

Indicators earlier this year suggested distress was rising most quickly in the South. However, the recent survey results suggest the concern may be more long term in the West.

Foreclosure starts in the South increased 15% from a year ago in the first quarter. This was the only year-over-year increase among the four regions, according to an analysis of data from Attom Data Solutions.

But the rise in foreclosure starts in the South is partly attributed to the lingering effects of

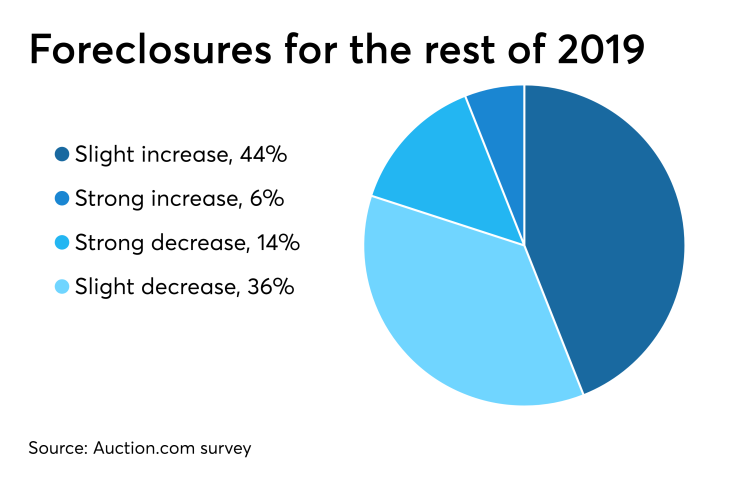

There was an even split between the share of servicers that expected higher foreclosure and real estate owned activity across the board for the rest of the year and those that expected a decrease, with 44% anticipating a slight increase, 6% forecasting a substantial rise, 36% calling for a slight decrease and 14% expecting a substantial drop.

A surprisingly higher number, 72%, are planning to increase their

In addition, property preservation was named as servicers' largest overall pain point, at 64%. Claims was next at 23%, followed by short sales, 7%, and asset management, 6%.

Mortgage late payments have been trending downward, with April having