Fannie Mae is holding to its forecast of a modest recession in the second half of this year, even as conflicting views emerge about the

Those discussions have also included whether the U.S. economy is heading for a soft landing instead of the downturn expected because of

"There are select data available to support several alternative views of the path of the economy, though we maintain our view that a modest recession will begin in the second half of 2023," said Doug Duncan, Fannie Mae's chief economist, in a press release.

The effects of that recession will be muted because of housing. Duncan

"It continues to outperform our expectations, and we expect that its relative strength will help kickstart the economy into expanding again in 2024," Duncan said. "Inflation has been resistant to Fed efforts to drive it down, and we view the risks to our baseline forecast as tilted toward more tightening rather than easing — although, for the moment, the Fed has adopted a wait-and-see approach."

April's

Rates are challenged right now by the ongoing negotiations over the debt limit ceiling. Meanwhile

Yields on the benchmark 10-year Treasury were at 3.71% at 10:00 a.m. on Friday morning, 21 basis points higher than they opened the week on Monday.

Fannie Mae improved its fourth quarter year-over-year gross domestic product outlook by 0.1 percentage point versus April, to -0.3%. But next year, GDP should grow 1.2%, but that is 0.2 percentage points lower.

While the total home sales forecast for 2023 was increased slightly, single-family housing starts were raised to 815,000 units on a seasonally adjusted basis from 779,000 in April.

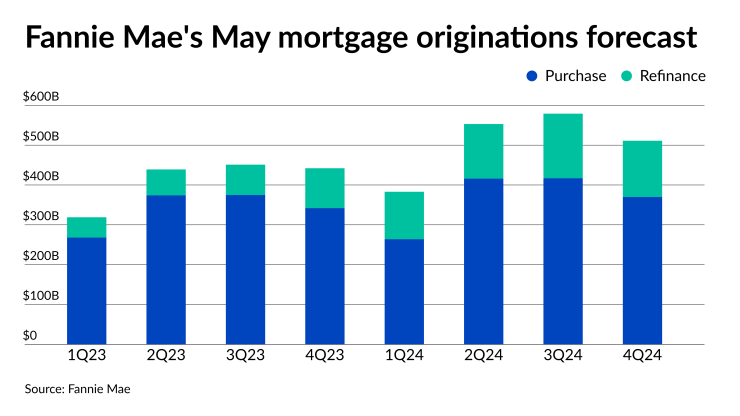

As a result, Duncan tweaked his mortgage origination forecast for this year in the May report, increasing purchase activity to $1.359 trillion from

That resulted in a drop of $6 billion for the total for 2023 to $1.65 trillion. Meanwhile, next year's projections were increased by $7 billion to $2.026 trillion from $2.019 trillion.