Affordability issues along with a lack of knowledge about home buying are holding millennials back from pursuing homeownership, according to a survey from loanDepot.

No longer wanting to pay rent and being ready to start a family are the top two drivers cited for wanting to buy a home, the survey found.

About half of the surveyed millennials are anxious about real estate and mortgage payments, and only 18% feel they can afford to purchase a home.

Millennials also described a number of reasons they are hesitant to enter the housing market. About 63% were concerned about not being able to afford a down payment, 48% were unsure of where to start (with 56% saying they'd resort to a Google search), 43% listed poor credit history, and about 38% think too much existing debt stands in their way.

"It's clear from the survey results that millennials have a lot of anxiety built up about the home-buying process," said David Norris, loanDepot's head of retail lending, in a press release.

"There is good news, however, as there's more flexibility than most millennials think regarding how to qualify for a loan and what's needed for a down payment," said Norris.

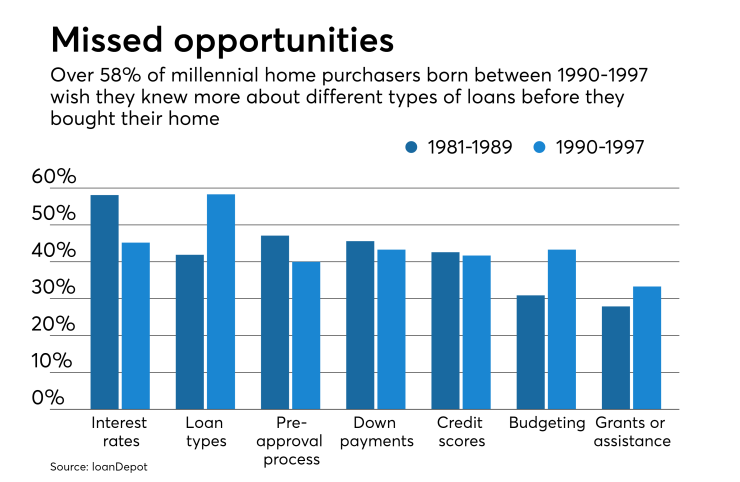

Of the 49% of

An area millennials feel largely misinformed on is the down payment.

Millennials who have not yet taken the plunge are overestimating how much they need for a down payment, with the average guess being 32%. While the industry standard is still 12 percentage points lower at 20% down, there are still other options available.

Fannie Mae and Freddie Mac opened the door for 3% down payment programs back in 2014, prompting big banks and other institutions to

"The best advice I have for young buyers is to not believe everything you read on the internet," said John Pearson, a Hoboken, N.J., loanDepot lending officer.

"When talking with a professional, you can discuss your specific financial situation and the lending officer can help you determine how much down you'll need and what a monthly mortgage payment will look like. You'll probably discover you don't have to wait until you reach the point of a 20% down payment," he explained.

Nearly 1.5 million borrowers made a home purchase using