A larger percentage of newly originated mortgages to millennials shifted toward purchase loans as interest rates stayed low, according to

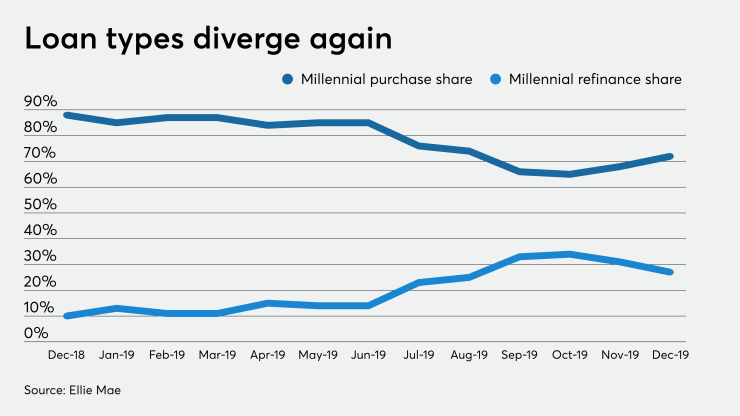

The purchase share continued increasing in December off the momentum of the preceding months, climbing to 72% from 68%

"The refinance boom potentially ending is a major topic of discussion in the industry at the moment, but the reality is that if we take a step back and look at the last year, overall

It took 43 days to close a loan, which held steady from both the month and year prior. Conventional mortgages accounted for about 71% of completed loans to millennials in December, while 24% were

"Whether millennials are refinancing more or increasing their purchase activity, the reality is that this demographic plays a central role in shaping the market," Tyrrell continued. "Lenders can best set themselves up for success by understanding that, throughout the mortgage process, millennials want automation and human touch

The average

Married individuals represented approximately 55% of loans closed, while 45% of primary borrowers were single. Nearly 59% were male, 31% female and 10% unspecified. The average loan amount jumped to $206,572 from $193,624 year-over-year and $205,682 from November.