Mick Mulvaney's recasting of the Consumer Financial Protection Bureau marks a new day for the agency, but a substantial part of his authority to unwind rules — particularly on mortgages — was already part of the agency's tool chest before he arrived.

Last summer, the bureau under then-Director Richard Cordray sought comment on the effectiveness of its mortgage underwriting and servicing rules, both issued in 2013. The assessments are part of a Dodd-Frank Act requirement that the agency conduct five-year "look-backs" to tell whether "significant" rules are working out as intended.

Observers said the look-backs will likely aid Mulvaney, appointed as the CFPB's acting director in late November, in his stated plans to ease bureau rules. The assessment process could result in significant changes to the mortgage rules, many said.

"The look-back review gives Mulvaney an opportunity to undo a lot of the legacy of Cordray, and I don't think anyone realizes it," said Ed Mills, a managing director at Raymond James. "This is fertile ground for revising the rules and gives Mulvaney the chance to make more significant changes."

Technically, the CFPB's five-year look-back reviews only require that the bureau issue a request for public comment and a report, and it is basically up to the agency which rules are "significant" enough to get a look-back. So far, rules slated for a look-back are not limited to mortgage policies; for example, the agency launched one in March for its remittance rule.

But the door is already open to the CFPB, under Mulvaney, using the mortgage rule look-backs to consider significant changes. The agency began the process in May of assessing the rule requiring lenders to validate a borrower's "ability to repay," as well as a rule imposing servicing requirements under the Real Estate Settlement Procedures Act. For both, the agency will issue reports on the assessment process in January of next year.

The statutory language in Dodd-Frank regarding look-backs is making lenders optimistic, and consumer advocates concerned, about the prospect of the rules being altered. The law states specifically that the CFPB can "modify, expand or eliminate" a rule under the look-back review.

For example, observers said, the agency could dramatically expand the definition of "qualified mortgages," known as QM — a category of safe mortgages deemed to be compliant with the "ability to repay" rule — to give more loans the special designation.

Mulvaney has not addressed the look-back reviews directly, although he said in a

"With the change in leadership, the CFPB will take these reviews much more seriously," said Richard Horn, founder of Richard Horn Legal PLLC and a former senior counsel at the CFPB. "The old leadership would look at these reviews with a rubber stamp."

But Sen. Elizabeth Warren, D-Mass., who was the architect behind the consumer bureau, said unwinding the CFPB's mortgage rules would remove consumer protections necessary to avoid a repeat of 2008.

“The CFPB’s mortgage rules stop lenders and servicers from cheating and misleading families, and they are critical to preventing the kinds of widespread predatory practices that led to the 2008 financial crisis," Warren said in a comment emailed to American Banker. "They should not be weakened just so that banks can add to their already record-high profits.”

The Trump administration has already signaled that it wants to take a look at revamping the CFPB's "qualified mortgage" rule, and the mortgage industry has long sought a clear and stronger safe harbor from liability if loans meet the QM criteria.

"We are re-examining the uncertainty caused by the qualified mortgage rule," Mark Calabria, the chief economist for Vice President Mike Pence, said last year. "We want a world where lenders are willing to take credit risk and we are not in that world today."

Yet, if changes are proposed as part of the look-back process, they cannot be implemented overnight. Revisions would still be subject to the Administrative Procedure Act. Meanwhile, it is not completely clear that Mulvaney would remain at the agency to see the process through, since the administration is considering potential nominees to become permanent director.

But the industry appears eager for changes to both the mortgage servicing and underwriting rules.

The servicing rule that went into effect in 2014 contained new mortgage servicing requirements such as early intervention with delinquent borrowers, continuity of contact with delinquent borrowers and loss mitigation procedures. It also imposed prohibitions on force-placed insurance, borrower assertions of error and borrower requests for information.

The Mortgage Bankers Association wants the CFPB to withdraw the servicing rule and issue a new rule that preempts more restrictive state laws, specifically California's Homeowner

The MBA said California's requirements have created confusion and added costs by forcing servicers to pause a foreclosure at any point before a sale when the borrower applies for loss mitigation. By comparison, the CFPB's national servicing standards give a borrower until 37 days before a scheduled foreclosure sale to submit a complete application for loss mitigation.

"I hope they want to provide more clarity to the market, which will expand the credit box," said Justin Wiseman, associate vice president and managing regulatory counsel at the MBA, of changes the CFPB could consider under through the look-back process.

But consumer groups say they would fight steps by the CFPB to preempt state servicing standards.

"We would strongly oppose any efforts to undermine the historic ability of state legislatures to oversee the foreclosure process," said Kevin Stein, deputy director of the California Reinvestment Coalition. "It's outrageous, especially at a time when the CFPB is rolling back consumer protections."

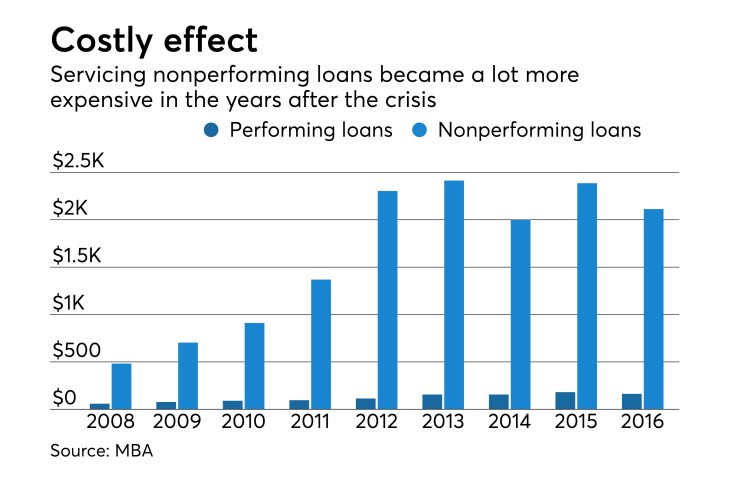

The MBA also wants an analysis of the impact of servicing rules on industry outcomes such as mortgage costs, origination volumes, approval rates and loan performance. As a result of the CFPB's mortgage servicing rule going into effect, the MBA said the cost to service a non-performing loan jumped nearly 350% to $2,113 in 2016, from $482 in 2007.

"There's been a bit of an outcry from the servicing industry about the requirements and how stringent they are, and they go beyond addressing the issues that were identified in the foreclosure crisis," said Karen Louis, an attorney at Taylor English and a former in-house attorney at Altisource Solutions. "Requiring that servicers and lenders invest a sizable amount of money into compliance programs may not actually be directly benefiting consumers."

In terms of changing the QM rule through the look-back process, the basis for revisions could be how the rule is seen as affecting the availability of loans in the market.

Dodd-Frank established significant penalties and liability if lenders failed to verify a borrower's ability to repay a loan. The CFPB's rule created criteria of loans presumed to meet the ability-to-repay standards including that a borrower's monthly debt-to-income ratio not exceed 43%.

The rule also granted automatic temporary QM status to loans eligible to be purchased by Fannie Mae or Freddie Mac. This so-called "QM patch" remains in effect until January 2021 or the date that the two mortgage giants exit their federal conservatorships, whichever is earlier.

The MBA has recommended 13 changes to the CFPB's qualified mortgage rule, including revising the process for determining a borrower's debt-to-income ratio to find ways for self-employed borrowers to qualify for credit.

"The justification to change the rule will be the lack of mortgage credit in the purchase market because there's a whole different demographic that is the next wave of homeowners and that group is not being served and is arguably being locked out by the regulatory infrastructure," said Mills.

The QM rule also limits the points and fees that lenders can charge for QM loans to 3% of the loan amount, which has also restricted lenders' ability to profit on small loans.

Because it costs more than $8,800 to originate a home loan, the cap on points and fees makes it tough for lenders to originate loans of $150,000 or less. (The average amount for a home loan in the U.S. is roughly $250,000.)

Mulvaney or his successor will also have to find a permanent fix for the QM patch.

"What we have seen from the CFPB on the margin is that they chose consumer protections over access to credit, and that was legitimate after the crisis," Mills said. "With Mulvaney, the question is whether consumer access to credit starts winning out over consumer protections and longer-term, what does it mean for the consumer?"