MGIC Investment Corp.'s second-quarter earnings coming in higher than expected can be seen as a positive for the other private mortgage insurers, one analyst's first take said.

The

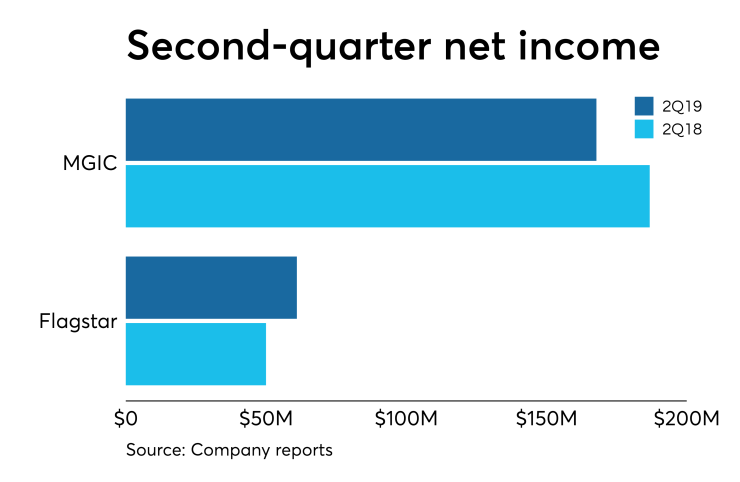

This is down from the $186.8 million, or $0.49 per share,

B. Riley FBR analyst Randy Binner expects the earnings beat trend to continue for other MIs, Radian Group and NMI Holdings.

"We remain bullish on the

"We expect

MGIC's new insurance written of $14.9 billion was ahead of Binner's expectations of $13.9 billion. One year prior, MGIC wrote $13.2 billion.

"As in recent quarters, MGIC's beat was facilitated by improvement in the company's credit profile, a $30 million reduction in losses incurred stemming from the release of reserves on previously received delinquent notices," said BTIG analyst Mark Palmer in his research report.

Insurance-in-force grew to $213.9 billion, compared with $211. 4 billion at the end of the first quarter and $200.7 billion from June 30, 2018.

"We continue to benefit from favorable employment and housing trends which contributed to an increase of insurance in force, a low level of new primary delinquency notices received, a decline of the primary delinquency inventory, and additional positive primary loss reserve development," MGIC CEO Patrick Sinks said in a press release.

Separately,

"Our mortgage team delivered a strong quarter as they maintained pricing discipline and grew gain-on-sale margin by 17 basis points compared to first quarter 2019 and 18 basis points compared to second quarter 2018," said Flagstar President and CEO Alessandro DiNello in a press release. "It is also the third consecutive quarter that gain-on-sale margin expanded. The improvement in net gain-on-loan sales more than offset a lower net return on mortgage servicing rights."

"During the quarter we recognized a $30 million partial charge-off related to the

Flagstar's net earnings also included a $25 million fair value adjustment benefit related to

Mortgage rate lock commitments dropped 7% from the second quarter of 2018, to $8.3 billion from $9 billion one year prior. Its net gain on sale was up 19% to $75 million from $63 million, more than offsetting a 44% reduction in net return on its MSRs to $5 billion from $9 billion.

Mortgage origination income at KeyCorp surged 43% from the year prior, while its servicing fee income rose by 9%.

"Our recent acquisition of Laurel Road and the investments we have made in

Consumer mortgage income was $10 million, up from $7 million one year ago, while mortgage servicing fee income grew to $24 million from $22 million.

But home equity loans on the balance sheet fell by $900 million — largely the result of consumers continuing to pay down their home equity lines of credit.