The median U.S. home price saw its biggest surge in 10 months, but the latest rise may not completely reflect the true nature of current trends, some experts say.

The median value of for-sale single-family properties shot up 4.8% to $379,975 on an annual basis for the four-week period ending Aug. 27, according to the latest figures from Redfin. The upturn was the largest since last October.

Indicative of the effect

The shortfall has contributed to an approximately 14% dip in pending home sales from a year ago, although

But Redfin also said the median-price jump had much to do with a rapid drop in housing costs that the market first saw in summer 2022, when interest rates began their steep climb upward. From 5.66% a year ago, the 30-year mortgage rate has jumped more than 1.5% percentage points in the past 12 months, according to Freddie Mac's weekly surveys. The

The observation was echoed by researchers at Black Knight.. Even if seasonally adjusted prices were to stop rising immediately, annual home price growth would still continue its upward trajectory, "simply due to price gains that are already 'baked in,'" said Andy Walden, Black Knight's vice president of research, in a press release.

Additionally, with unadjusted monthly gains slowing this summer compared to historical averages in July, Black Knight rate lock and sales transaction data also point to lower average purchase prices and seasonally adjusted price per square foot among recent sales," Walden said, "suggesting a possible transition might be underway."

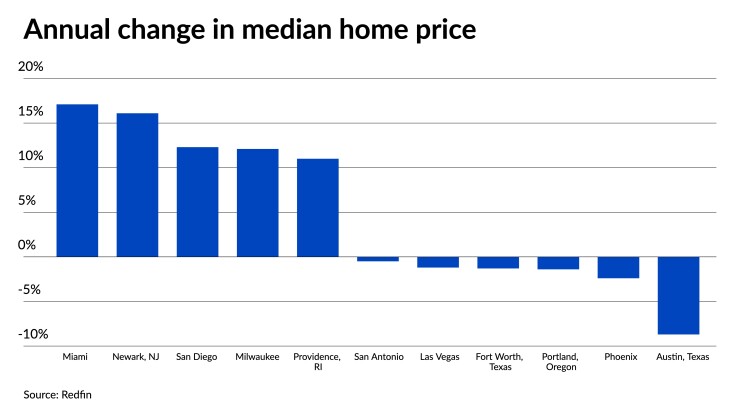

In Redfin's August data, the company found median values up in 44 out of 50 markets covered, led by Miami's 17.1% year-over-year increase. It was followed by Newark, New Jersey, at 16.1% and San Diego at 12.3%.

Miami's price-growth rates outpaces the national average by such a large degree, as the city never posted any annual drops in the first half of 2023 unlike the rest of the country, Redfin said. The market is also unique in the number of out-of-town buyers and investors it sees who often purchase properties in cash.

The six metropolitan areas experiencing annual drops in their median home price were concentrated in the Southwest. Austin, Texas, recorded the largest drop at 8.7%, followed by Phoenix at 2.4%. Portland, Oregon, Fort Worth, Texas, Las Vegas and San Antonio also saw annual decreases, all below 1.5%.