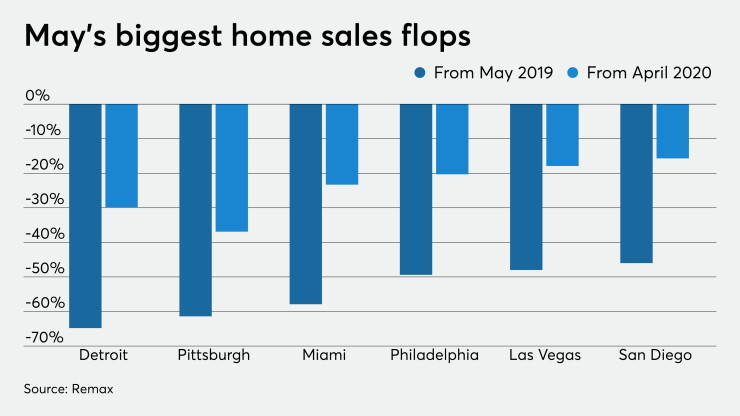

Normally a top month for home purchases, May sales plummeted from the year-over-year average, with the coronavirus effect socking the housing market for the second straight month, according to Remax.

Closed transactions

Bottlenecked inventory strained matters further. May's housing supply dropped to near-12-year lows, plunging 25% year-over-year and 4% month-to-month. Only three of the 53 metro areas posted annual increases. Inventory rose 12.7% in Indianapolis, 4.3% in Wichita, Kan., and 1% in Chicago.

Overall, housing supply slipped to 2.5 months from 3 months the year before and 3.7 months in April. A supply of 6 months defines market equilibrium. The average days on market held at 46 days from April but dropped from 48 in May 2019.

The tight inventory was likely behind a rise in home values in May, according to a separate data analysis by Radian. Prices grew at a 7.8% annual rate and 4.5% month-to-month, according to

"Home price gains across the U.S. slowed in May, a month typically known for accelerating activity," said Steve Gaenzler, SVP of data and analytics at Radian. "Softer home price appreciation across the U.S. compared to the prior month suggests that the full impact of COVID nationally or locally on home prices may not yet be felt, but we are encouraged by some of our leading indicators."

Many watching the market are pinning their hopes on a turnaround as stay-at-home orders lift.

"We believe the spring selling season was largely deferred for several weeks," Adam Contos, Remax CEO, said in a press release. "And, with home being the center of people's lives this year, we could see the effect of

One of the indicators for the housing market is construction. While

"Housing construction inched up in May, but single-family starts remained almost 18% below last year's pace, and multifamily starts were 33% lower. At only 9% below last year, new permits are recovering more quickly and are an indication that the pace of construction should continue to improve in the months ahead," said Mike Fratantoni, chief economist of the Mortgage Bankers Association.

"MBA's