Banks pay their loan officers less than independent mortgage bankers do, but the level of sales support provided negates the difference, a study from Stratmor Group said.

On a per-loan basis, loan officers working for bank-owned/affiliated mortgage companies make an average of 74 basis points per loan of the amount. Their counterparts at independent mortgage bankers make an average of 120 basis points.

The

"While not the primary driver in differences in compensation plan payouts, the greater marketing support provided by banks to their loan officers is certainly a factor in allowing them to pay lower commissions than the independents," Stratmor said in its monthly Insights publication.

Banks also provide their loan officers with brand recognition in their communities and a referral base of people that already have a relationship with the depository.

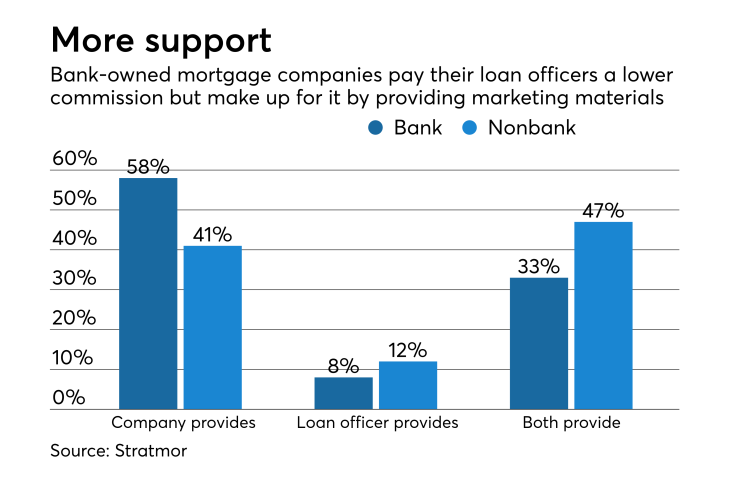

Among the loan officers that work for a bank, 58% responded the company provides their marketing materials and 75% said the company paid for their personal website. For nonbank loan officers that was 41% and 53%, respectively.

Just under half of the nonbank loan officers, 47%, said they split the cost of their marketing materials with their employer. This was true for 33% of bank loan officers. Meanwhile, 8% of those working for banks and 12% for nonbanks have to pay for their own marketing materials.

When it comes to a personal website, 29% of those working for an independent mortgage banker have to pay for their own, while 17% of bank-employed loan officers do the same. Another 18% of nonbank and 8% bank loan officers responded they split the cost of their personal website with their employer.