Lower interest rates and improved gain-on-sale margins helped Impac Mortgage Holdings record its first profitable three-month period since the first quarter of 2018.

Impac reported net income of $3.9 million for the second quarter, versus losses of $12.6 million

The increase over the prior year was a result of the gain-on-sale margin to 359 basis points from 181 basis points in the second quarter of 2018, as non-qualified mortgage production increased to 38% of all loans originated compared with 30% over the time frame, as well as an increase in lower-cost consumer direct originations.

"Without question the story of the second quarter of 2019 is shaping up to be the story of the year,

"More specifically, what appears to be the inexorable march to a zero or

For July, call center volume was nearly $355 million, with August projecting to $450 million.

"Concurrently, the company continued to drive non-QM originations at attractive margins through our third-party origination channel, pressing our competitive advantage in the alternative market segment that is central to our core mission," Mangiaracina continued. "The call center and TPO channels are complementary, taken together they serve as a force to monetize near-term opportunity and to drive long-term franchise value creation for our stakeholders."

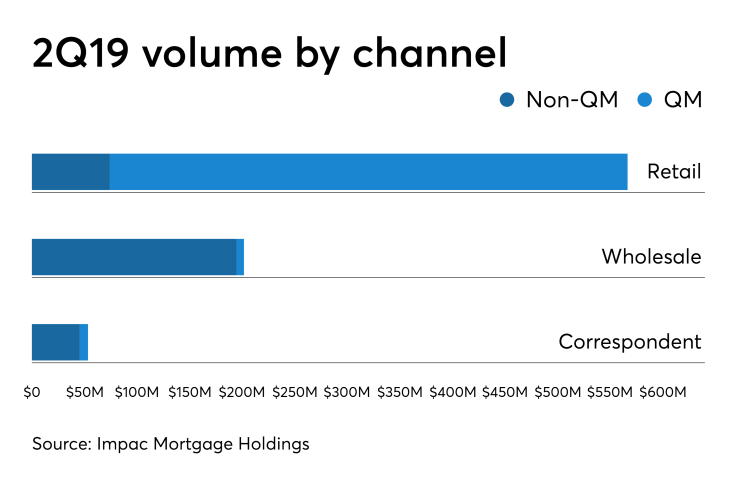

Impac originated $821.4 million in the first quarter. Of the $202 million in loans originated through the wholesale channel and $52.9 million purchased in the correspondent channel, $195.2 million and $45.3 billion, respectively, were non-QM. Total non-QM production was $315.1 million, with an average credit score of 732 and average loan-to-value ratio of 70%.

In the first quarter, Impac originated $581.5 million, of which $343.3 million was non-QM, while in the second quarter of 2018, it did over $1 billion, of which $306.1 million was non-QM.

Because of lower loan origination volumes, Impac reduced overhead throughout 2018 and into 2019 to more closely align its staffing levels to origination volumes in the current economic environment. As a result of the staff reductions, average headcount decreased 18% for the second quarter of 2019 as compared to the same period in 2018.

But that trend is changing with the higher volumes originated over the last two months. "At the end of the second quarter, the company had 397 total employees, and as of today, we have grown to 446 employees. Our expectation is that our headcount will increase to approximately 480 by the middle of this month," Chief Administrative Officer Justin Moisio said during the conference call.

Impac had a loss of $9.9 million on its mortgage servicing rights, compared with a gain of $167,000 one year prior. The company needed to take a $9.9 million reduction in the fair value of its MSR portfolio, of which $6.9 million was related to an increase in prepayment speed assumption because of the drop in interest rates during the period.

The servicing portfolio was at $5.96 billion as of June 30, down from $6.24 billion on March 31 and $16.79 billion on June 30, 2018. The year-over-year decline was due to a fourth quarter 2018

Net servicing fees rose from the first quarter, to $3.5 million from $3 million, but because of the MSR sale, fell from $9.9 million one year prior.