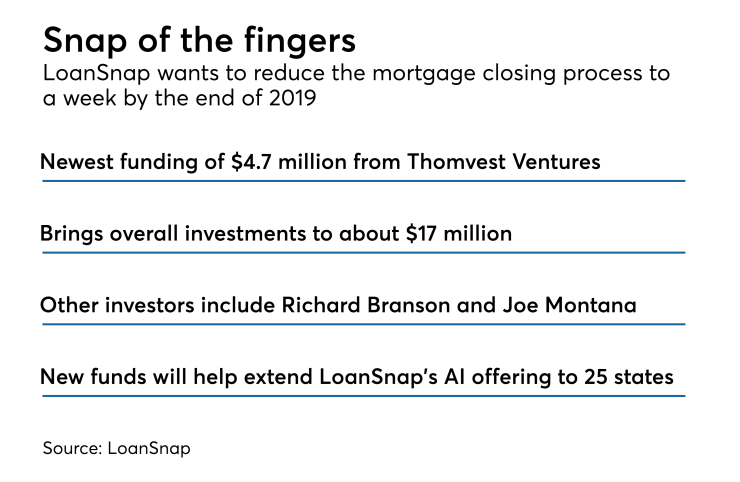

With its new round of funding, the mortgage fintech company will look to expand its geographic reach and reduce the mortgage closing process to a week in 2019.

By the year's end, LoanSnap wants to increase its smart loan technology offering to 25 states. Its artificial intelligence model analyzes a consumer's financial situation and matches them with the best individualized mortgage options.

"Since our launch last year, we've received widespread positive feedback and we've helped our customers improve their financial situation," Karl Jacob, CEO and co-founder of LoanSnap, said in a press release. "This financing is a recognition of our strong progress toward helping consumers improve their financial situation. We are excited to have Thomvest Ventures as our strategic partner as we work to make financial stability more accessible to all Americans."

Thomvest Ventures financed LoanSnap with $4.7 million to accelerate the company's goal.

"We are excited to work with Karl Jacob, Allan Carroll and the entire LoanSnap team on their journey to improve housing finance," said Nima Wedlake, principal at Thomvest Ventures. "As part of this investment, we plan to explore further ways to partner across the broader Thomvest platform, including via our real estate and credit funds."

With Thomvest's investment, LoanSnap now has around $17 million in funding. The rest of the backing came from its Series A round led by