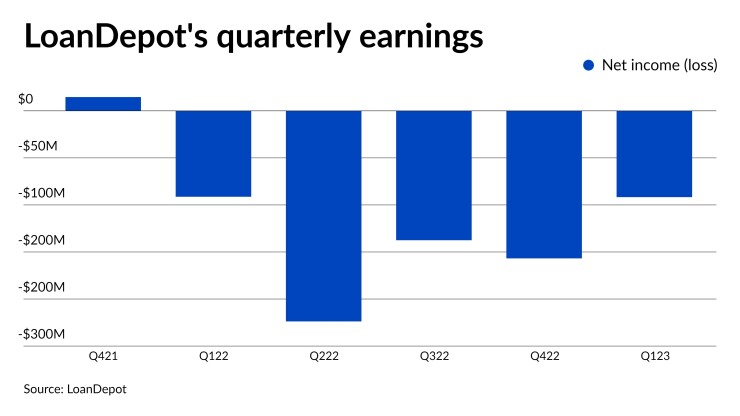

LoanDepot is anticipating a rough year but is promoting positive progress from the first quarter, as it shrank big losses to eight figures.

The

Executives in a brief conference call Tuesday didn't mention

"Together these positive trends should continue to drive improving financial results over the course of the second quarter and the third quarter of 2023," said Martell.

LoanDepot slashed its headcount from over 10,000 employees a year ago to 4,800 workers to end the first quarter, it said. The company posted total expenses of $314.5 million, down 9% from the prior reporting period and 48% from the first quarter last year. At the beginning of the year, the company spent $2.6 million on Vision 2025 costs including personnel charges, lease costs and professional services fees.

The Irvine, California lender's origination volume fell 22% to $4.9 billion in the first quarter, production down 77% from the same time last year when

LoanDepot's revenue grew 22% quarterly to $207.9 million in the first quarter, the result of higher servicing income and more pull-through weighted rate lock volume from lower average interest rates, the CFO added. At the same time last year, the lender reported $503.3 million in total revenue.

The company's servicing portfolio was flat quarter-over-quarter at $141.7 billion to begin the year, but Flanagan touted it as a strength for the firm. LoanDepot didn't have any bulk sales from the portfolio during the first quarter, and saw its servicing fee income rise slightly to $119 million in the first quarter from $107 million at the end of 2022.

The portfolio is also well protected against

"These characteristics contributed to a low delinquency rate, with only 80 basis points of the portfolio more than 90 days past due at quarter end, and should generate reliable and ongoing revenue during these uncertain economic times," said Flanagan.

In anticipation of a $1.5 trillion mortgage market this year, loanDepot in the past few months has

LoanDepot, which captured a 2% market share to begin the year, is projecting origination volume between $4.5 billion and $6.5 billion between April and June. The anticipated bump in production however won't drive the company to halt its downsizing plans.

"We're always looking to add good originators with the right profiles," said Jeff Walsh, president of loanDepot's Mortgage division. "But we feel based on what we're estimating the market to be currently that we're well positioned with the originators that we have today to manage that."