After weeks of speculation, loanDepot has

The number of shares to be offered and the price range for the proposed offering have not yet been determined. If the offering goes through, loanDepot plans to list its common stock on the New York Stock Exchange under the symbol "LDI."

This is the second time the company is attempting to go public. Its

There were reports that the company was again considering going public

While a spate of mortgage companies announced IPOs

Two other proposed IPOs — AmeriHome and Caliber Home Loans — were pulled

Among loanDepot's selling stockholders is Parthenon Capital, which acquired an interest in 2009, the prospectus said.

"We now possess roughly 3% market share of annual mortgage origination volumes, which makes up part of the $11 trillion total addressable market," loanDepot's CEO Anthony Hsieh said in the prospectus. "To some, it may seem like we are in a much different place than we were eleven years ago," he wrote, referring to the company's 2010 founding.

For the first nine months of 2020, loanDepot earned $1.47 billion, up from $18.2 million for the same period in 2019. It lost $102.9 million in the full year of 2018.

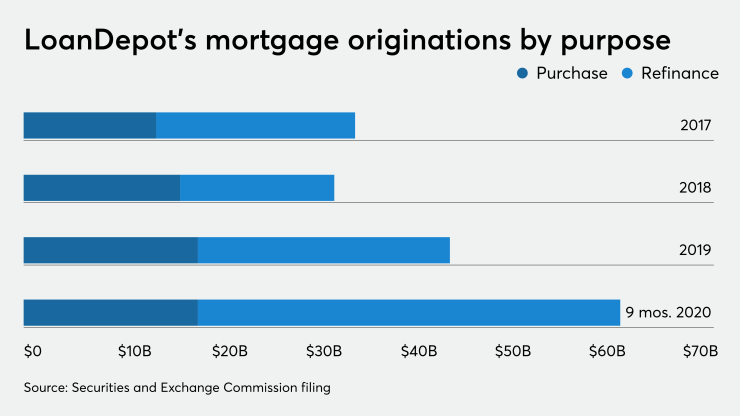

From the start of 2020 through Sept. 30, loanDepot originated $63.4 billion, of which $50.6 billion was retail. The remaining $12.8 billion came from the company's "partner program," which included loans sourced through mortgage brokers, joint ventures with real estate brokers and homebuilders, and other referral partners.

During the same period in 2019, it did $29.3 billion, with $21.3 billion coming from retail.

Gain on sale was 480 basis points for the first nine months of 2020, with retail originations recording a 496 bps gain on sale and partner originations at 334 bps. For the nine months ended Sept. 30, 2019, gain on sale was 306 bps, with retail at 367 bps and partner at 115 bps.

LoanDepot's servicing portfolio as of Sept. 30, 2020 was $77.2 billion, more than double the $30.6 billion on the same day in 2019. But because of the pandemic, the share of loans 60 days or more late on their payments grew to 2.7% from 1.1%.

Nearly all of its mortgage servicing rights are being subserviced by Cenlar, the prospectus said.

Among the investment bankers handling the IPO are Goldman Sachs & Co., BofA Securities, Credit Suisse and Morgan Stanley, which will be lead book-running managers; Barclays, Citigroup, Jefferies and UBS Investment Bank will be book-running managers; and JMP Securities, Nomura, Piper Sandler, Raymond James & Associates and William Blair will be the co-managers.