LoanDepot has created a digital-first business unit, mello, in a major operational shift, separating it from lending operations as it attempts to develop services aimed at building life-long customers.

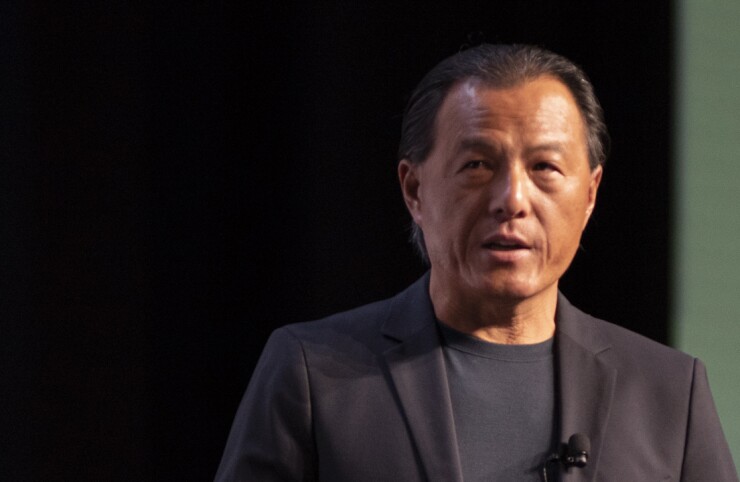

The Foothill Ranch, California-based lender and servicer tapped finance and banking leader Zeenat Sidi as mello’s president and chief operations officer to lead the creation of new digital secured and unsecured lending products. Mello will operate as a complementary business to loanDepot’s lending and servicing, with both units reporting to CEO Anthony Hsieh.

Under Sidi’s leadership, the mello division will also house loanDepot’s other mortgage-related businesses, including mellohome Real Estate Services, melloinsurance and mello title and escrow services (CUSA, ACT). The company will move its customer contact center and performance marketing engine to the mello unit as well.

"Customers want bundled options and appreciate complementary homeownership products and services being readily available from one source,” Hsieh said in a press release.

“

In a press release, Sidi said she looked forward to helping “shape the trajectory of the home loans industry” at loanDepot. She comes to the company from

The move comes after loanDepot reported that its

The Mortgage Bankers Association recently forecasted originations to decrease by over one-third from 2021’s volume of $3.99 trillion last year.