The average commission earned per loan officer in March was over $8,000 higher than compared with January's average — even as housing market activities were affected by the coronavirus spread, a report from LBA Ware found.

"Intense market demand for mortgages, including refis, helped loan originators earn average commissions approaching $19,000 in March," said LBA Ware CEO Lori Brewer in a press release. "LOs may want to sock some of that payday away as the industry braces for a protracted economic recession, job losses and stiffer underwriting criteria."

The 9,042 loan officers tracked in the study pulled in nearly $171 million in total commissions during March, earned from $16.7 billion in funded loan volume. That worked out to an average per-month commission of $18,907.

By comparison, January notched $102 million in commissions on $10.1 billion of funded volume, while in February, $116.4 million in commissions were earned on $11.4 billion in loans. Per-month commissions averaged $11,800 and $13,294, respectively.

This was LBA Ware's first quarterly report on the data, which comes from its CompenSafe technology.

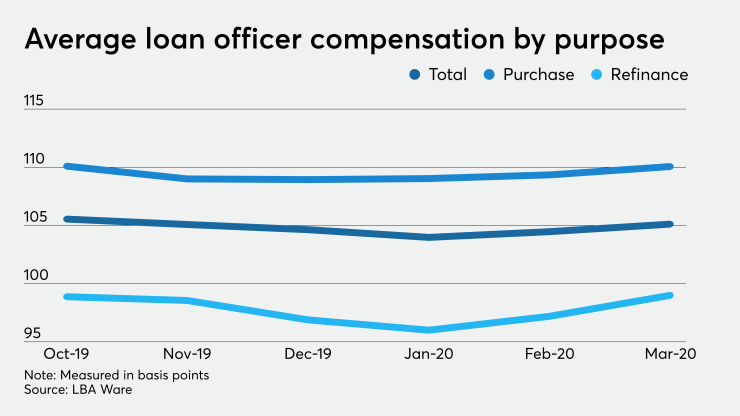

March's average compensation of 105.116 basis points per loan was topped only by October's 105.547 bps in the six months covered by the report.

In a previous LBA Ware report that

The expected shift to a refinance market — Freddie Mac recently

According to LBA Ware's data, for the six months between October 2019 and March, refis averaged between 11 bps and 13 bps lower in commissions than purchase mortgages.

For March, when