Mortgage borrowers buying new homes generated more loan applications this September than they did a year ago, even though interest rates are higher this year.

Loan applications for new-home purchases were up more than 8% from September 2017, according to the Mortgage Bankers Association's Builder Application survey.

"Even though new-home sales decreased 3.9% over the month, the average monthly number of homes sold so far this year (648,000 units) is around 8% higher than a year ago, and last month's 8.2% annualized gain in purchase applications points to continued demand for new homes," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

"Housing demand is still strong even as mortgage rates increase, and as a result, we're still forecasting for modest growth in purchase origination volume in 2018," he added.

Although applications for new-home loans were higher year-to-year, they were down 9% from August.

A seasonal decline in home buying tied to the start of the school year likely accounts for the month-to-month decline in new-home purchase applications, and affordability constraints that make it more attractive to buy when the market is a little slower may be driving the year-to-year increase.

Conventional loans represented 71% of new-home purchase applications in September. Federal Housing Administration loans accounted for 16% and loans insured by the Department of Veterans Affairs represented nearly 12%.

Rural Housing Service and U.S. Department of Agriculture loans accounted for the remaining 1.1% of new-home purchase applications in September.

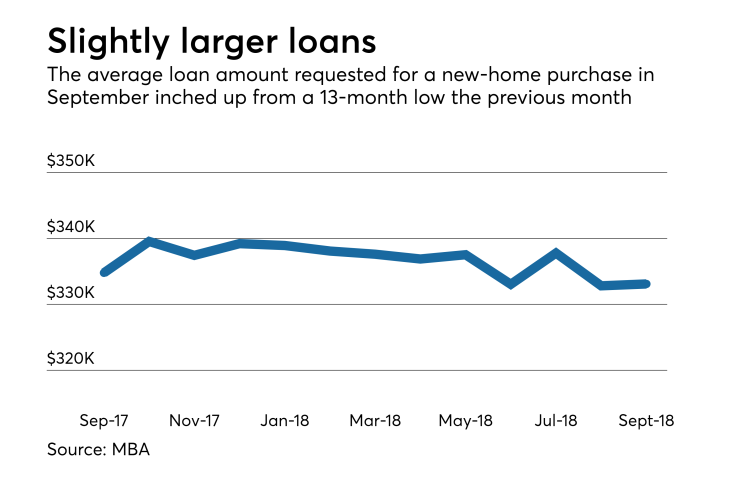

The average size of the loans sought in new-home purchase applications increased slightly last month, rising to $333,086 from $332,801 the previous month. A year ago, the average loan size in this category was $334,722.