Mortgage application activity fell for the seventh time in eight weeks, undeterred by three straight weeks of

The MBA's Market Composite Index dropped 2.5%

“The purchase market’s recent slide comes despite a strengthening economy and labor market,” Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release. “Activity is still above year-ago levels, but

The Refinance Index decreased 1% on an unadjusted basis from the previous week and dropped 18% from the year-ago level. Conventional refis dipped 1.7% week-over-week while government mortgage refi volume rose 0.8%.

The refinance share of application volume grew again, going to 60.6% from 60% last week.

Meanwhile purchase applications fell 5% on a seasonally adjusted basis and 4% unadjusted compared with the previous week. However, unadjusted purchase application volume spiked 34.1% compared with a year ago.

The average size for all loan types this week crept down to $330,000 from $330,200 one week earlier. Purchase mortgages also fell to an average price of $400,100 from $406,100 while refinancings jumped to $284,300 from $279,500.

The share of adjustable-rate mortgage applications edged down to 3.5% from 3.6%.

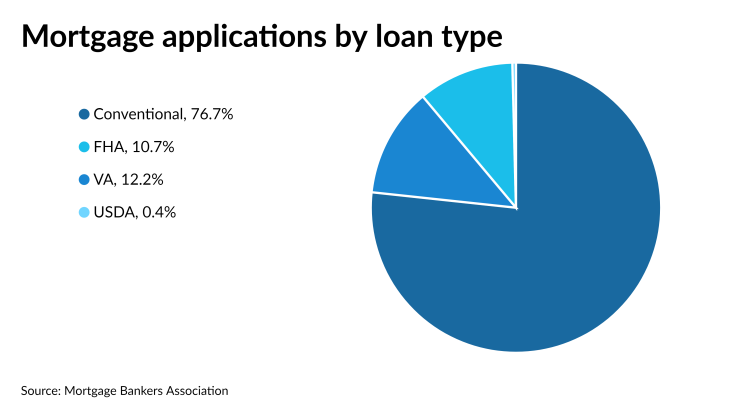

The share of Federal Housing Administration-insured mortgage applications dropped to 10.7% of the total from 11.3% week-over-week. The Veterans Affairs-guaranteed share grew to 12.2% from 11.5% while the U.S. Department of Agriculture/Rural Housing Service remained static at 0.4%.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) decreased to 3.17% from 3.20% a week ago, while the rate for jumbo loans also decreased to 3.28% from 3.34%.

The average contract rate for FHA loans fell again to 3.12% from 3.15%, and the 15-year FRM dropped 10 basis points to 2.55%. Rates on the 5/1 ARM decreased to 2.59% from 2.67% last week.