With the majority of election results in, the Golden State’s ballot measure to expand rent control, Proposition 21, looks as though it will not pass, leaving commercial financing entities to claim victory over one of the

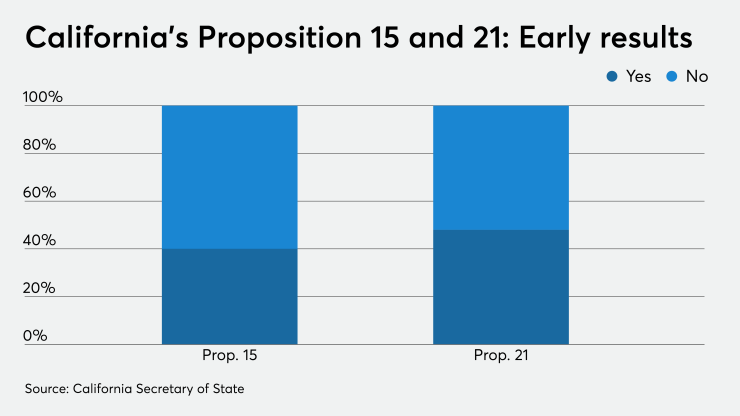

With 99% or 20,290 of 20,497 precincts partially reporting Wednesday morning, the measure that would have put state rent-control policies back in the hands of local authorities was opposed 60%/40%, according to unofficial election results posted by the state. Certified results are due Dec. 11.

Mortgage lenders have been concerned about the measure because expanded rent control could result in a patchwork of different policies that could complicate underwriting and discourage lending. An industry trade group responded to early results with cautious optimism.

“The early returns are very promising. So far, we’re happy with the outcome,” said Mike Flood, senior vice president of commercial and multifamily policy at the MBA, commenting on early election results. “If I’m a lender, I would have to think whether it makes sense for me to lend in nearly 500 cities with different rules.”

By Wednesday morning, votes were more evenly split on another ballot measure the group opposed due to the concerns of commercial lenders financing multifamily and other income-producing properties.

Prop. 15, which would subject commercial property owners to regular tax assessments rather than assessments based on purchase price, had a yes/no split of 52% and 48%, respectively.

Lenders feared that the additional taxation created by Prop. 15 could, like complex rent control, complicate underwriting and hurt credit availability.

A wide range of commercial and multifamily lenders were carefully observing the outcomes of both ballot measures, according to Flood.

“It’s a concern for darn near every lender in the country that has a presence in California be they a nonbank, a bank, a CMBS lender or otherwise,” he said, noting that because of the state’s large size, many national entities do have exposure to the market.

Some of the top banks in the country have large commercial real estate loan portfolios in California. Both those banks and the government-sponsored enterprises are heavily involved in multifamily lending in the state.

If Prop. 21 is defeated, it will be the second time expansion of rent control measures has been rejected by California voters. In 2018,

Prospects for Prop. 15 remain more of a concern in part because its supporters have seen it as a way to help resolve state budget gaps. There are mixed views on whether it might

Flood acknowledged that California has an affordable housing crisis that needs to be addressed, and said that the association plans on seeking out alternative means of doing that.

“We’re looking forward to working with the state to find more appropriate ways to solve the affordability crisis,” he said.