To reach the most desirable group of potential customers — young borrowers in

"If millennials were the first digital native generation, Gen Z is really mobile native," Austin Kilgore, Javelin's direct of digital lending, said in a recent webinar. "I would really challenge all you lenders and servicers out there to think about your digital touch points, not just from a 'I can do something online,' but what can I do from my mobile device?"

Lenders need to understand how mobile devices play a role not just for the consumers but for their next generation of

"The way you provide technology and the tools that you provide to do the job is going to have an effect on your ability to recruit and retain the best talent," Kilgore said.

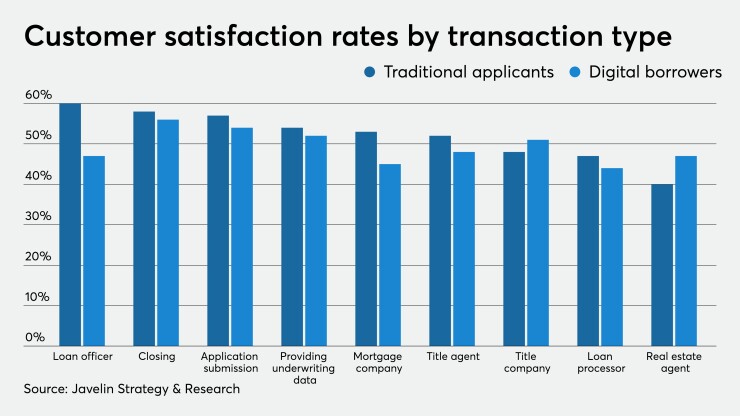

A study by the company, conducted for ServiceLink and its Exos unit, surveyed consumers who went through the digital mortgage application process and compared them to those who went through the more traditional paper based process or a mix.

A general trend emerged that surprised them: Many consumers that went through a digital mortgage application process actually ended up having

"That was a head-scratcher at first," said Kilgore, who is a former editor-in-chief of National Mortgage News.

"But when we started thinking about it, the thesis that we come to the conclusion on is that if you're only doing that initial application process in a very sophisticated and enhanced digital engagement, you set a very high expectation with the consumer and then you're not continuing to meet that expectation on to the end of the process," he said.

Javelin looked at appraisals and

It found that younger consumers like those mobile natives in Gen Z have a lower tolerance for inefficiency in the process than their older cohorts.

Javelin recommended using more customer

It also can make the appraiser more productive and cut their costs at a time when the industry's ranks continue to thin and their margins are tight.

Friction can be reduced in closings by allowing the borrower to engage with the process before they actually have to come to the table, Javelin recommended. Consumers who were able to review the documents and

"The most successful digital strategies are the ones that use technology to enhance their loan officers and elevate their role as a trusted advisor and make them a much more valuable piece of the process," Kilgore said.

Separately, appraisal company Solidifi surveyed 1,000 consumers that purchased a home in the last two years (including 39% that did so during the pandemic), on their reactions to the valuation process and closing.

The survey found that 87% wanted some form of

Those numbers were relatively unchanged whether the borrower did their transaction before or during the pandemic, Solidifi said; 89% for pre-pandemic transactions wanted some human interaction, while it was 83% for those who closed during COVID.

But 85% of Gen Xers and millennials wanted a more digital experience, versus 57% of baby boomers. Across all age groups more than half wanted the ability to review documents prior to closing.

"This year's survey confirmed that COVID-19 did not significantly change the borrower's desire for human interaction and did not substantially change a borrower's desire to close online," Loren Cooke, Solidifi's president, said in a press release. "Given the significant investments that lenders are making in digital capabilities today, we believe there is an opportunity for lenders to better educate consumers on the closing process, including what to expect and the digital tools that are available to them."