Editor's Note: This is part one of a three-part series on the changing demographics of mortgage borrowers. Read

With mortgage originations on the decline this year, lenders that want to regain lost volume or grow market share must work harder to identify and reach underserved borrower segments.

Reaching these borrowers may take more work, but it's an essential strategy at a time when regulatory and investor requirements limit how much lenders can open up the credit box to bring in more borrowers.

Lenders need to go beyond the usual efforts and employ strategies that dig deeper. Some lenders, for example, are taking a closer look at Home Mortgage Disclosure Act data in combination with demographic information to identify and reach out to underserved ethnic groups in their geographic footprints.

Rather than thinking of certain borrowers as square pegs in round holes, lenders and investors are increasingly realizing that they will get further if they make changes to accommodate customers, rather than trying to make people fit into pre-existing molds.

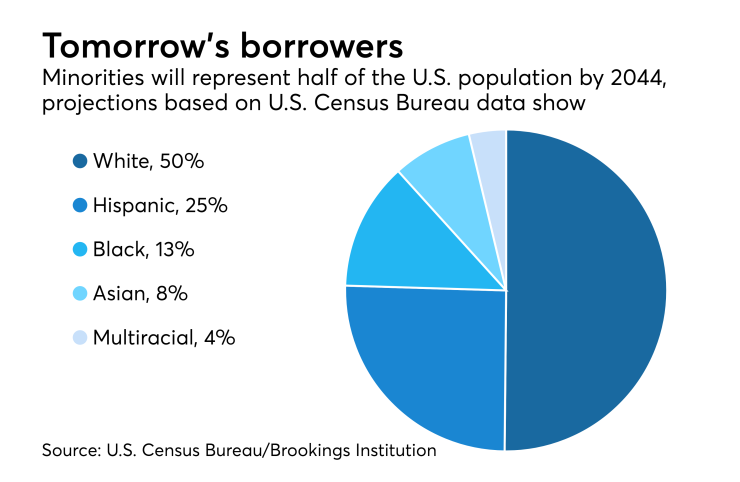

These tactics are not just short-term solutions. As consumer demographics continue to change, lenders that effectively manage them will set themselves to maximize their outreach to their evolving customer base long term.

About one-third of purchase mortgages go to borrowers in racial or ethnic minority groups, according to

Lenders are taking a closer look at marketing to underserved ethnic and racial groups because of market share numbers like that, according to Kristin Messerli, managing director of consulting firm Cultural Outreach Solutions. "The demand has increased significantly for having a diversity strategy from a business perspective," she said.

With these changes coming, even lenders already doing a lot of comparative analysis of demographic data and outreach to underserved markets may feel they need to raise their game.

"We're always looking for better sources of data because household migration is moving at a faster rate than some of the data points," said Jason Madiedo, president of Alterra Group, which does business as Alterra Home Loans. "We're ahead of the curve. We just want to get better at it."

The first step in analyzing lender outreach to racial and ethnic markets is usually looking at HMDA, Messerli said. Some lenders can be gun shy about using HMDA for anything but compliance and worry that reaching out to one group could be perceived as a bias.

"They're worried about targeting and you do have to be very careful, but what they don't realize is they are already marketing to a particular demographic, which is usually the one that they are made up of, said Messerli.

HMDA is really a compliance tool that wasn't designed for marketing, but lenders nevertheless "could and should look at it for that," said Maurice Jourdain-Earl, a managing director at ComplianceTech, a fair lending consultant and software vendor.

"With HMDA, most folks are focused on the compliance, but they could use the data to gain some insight that could help them better understand their market opportunity for growth," said Trey Sullivan, CEO of TruPoint Partners, a compliance software and consulting firm.

Alterra uses HMDA data to draw up some of its business strategies, but Madiedo said lenders should keep in mind that it's older data.

"It's going to be much more detailed in the future, and depending on the speed at which it is released, it could be more useful," he said. "For now, we use it more to understand where competitors are lending in our space."

Alterra mines HMDA data with a ComplianceTech tool that analyzes lenders, borrowers, markets and neighborhoods and compares it to several other data sources, including the Nationwide Multistate Licensing System and Registry and the National Association of Hispanic Real Estate professionals, where Madiedo is a former president.

For its go-forward view of data, Alterra works with iEmergent, an advisory firm that draws up projections that can drill down to details beyond ethnic group, like income level.

Drilling down into specific market segments and data comparisons can identify a lot of new opportunities. Lenders can better see whether they are really reaching all corners of the market when they look at more granular data.

Quicken Loans doesn't target particular groups exclusively, but does examine statistics from various parts of the market to identify larger subsets to address in the rotating consumer-facing informational articles it posts on its website.

"Like any good lender, we're trying to find out what the market is and how do we serve that market," noted Quicken EVP Bill Banfield. "The market is enormous and it's not one-size-fits-all. It's millennials, first-time home buyers, single women and more."

Single home buyers represent almost one-quarter of the market, according to the National Association of Realtors. Further divide the segment by gender and it becomes clear that most of those home buyers are women, who represent a 17% share, compared to just 7% for men.

Furthermore, single women's share of mortgages is 19.47%, while single men's share is 28.89%, according to an Urban Institute analysis of HMDA and CoreLogic data. Single women also on average paid 0.02% more for loans, even though their default rate is 0.06% lower than men's.

"The market is enormous and it's not one-size-fits-all. It's millennials, first-time home buyers, single women and more."

— Bill Banfield, EVP, Quicken Loans

Single women as a group have lower average incomes than men, which could be a factor in this disproportionate lending and pricing. That also can be said of many underserved borrower groups as a whole, so affordability is a key challenge in reaching many underserved borrowers.

But lenders who make assumptions about a borrower's income based on a group he or she belongs to can undermine their own outreach efforts and possibly cross the line into being discriminatory.

For example, while African-American incomes are lower on average, their wages in higher income brackets are growing faster than other groups.

Over a recent eight-year period, African-Americans in the $200,000-plus income bracket saw their incomes grow 138%. By comparison, incomes in the U.S. market as a whole grew just 74%, Messerli noted, referencing a Nielsen study.

While Messerli typically starts introducing borrowers to new borrower segments by helping them run a data analysis they need to follow up it up with more qualitative steps to actually reach the underserved populations identified by statistical analysis.

For example: If a lender is working with limited English proficiency borrowers, a group that constitutes 9% of the U.S. population, or over 25 million people, they might also be working with a translator.

Some loan officers might focus more on the translator than the borrower in those cases, but Messerli learned as a social worker working with immigrant groups that the person being translated wants the focus to be on them.

If lenders are consistent with their efforts, strategies like cultural sensitivity training, hiring and other community involvement can help deliver a return on investment from their outreach in as little as six months, Messerli said.