"It's not if it will happen, it's when it will happen."

Security breaches in the mortgage lending space are inevitable in 2021, said Teri Hermann, chief risk officer at Evergreen Home Loans.

When the COVID-19 outbreak forced everyone into lockdown, companies scrambled to go fully remote. That escalation in digital activity paired with the broader upheaval created by the pandemic and created the ideal atmosphere for scammers. Successful fraud efforts on mortgage lenders rose to an average of 721 per month in 2020, up from 460 in 2019, based on

While the transitory phase passed, remote work will be more common going forward, even when returning to offices is generally considered safe. At home, employees should stay on their company's VPN to ensure data encryption and use multifactor authentications. Just like braving the cold in winter, the best way to combat fraudsters is through layers of protection, according to Hermann.

"The bad guys are very good, they know different ways of getting into the systems," Hermann said. "Endpoint detection software is really important because 80% of the time, they'll get in through somebody clicking on a link or opening an attachment that they shouldn't. You also need good antivirus software, firewalls, and a good email security tool as well."

This model lines up several defenses against fraud with the idea being that one will catch it if it gets past another.

Compromising business email has become an increasingly popular method for stealing money this year, according to James McQuiggan, security awareness advocate at cybersecurity firm KnowBe4. Through phishing scams, the criminals can access email addresses of real estate agents, title officers and mortgage brokers. They then message the borrowers with fake account numbers to redirect the wire transfers of funds and down payments.

"By the time the real estate agent realizes the mistake, the cybercriminals have moved the funds around between various banks and then withdrawing it would be difficult to trace," McQuiggan said.

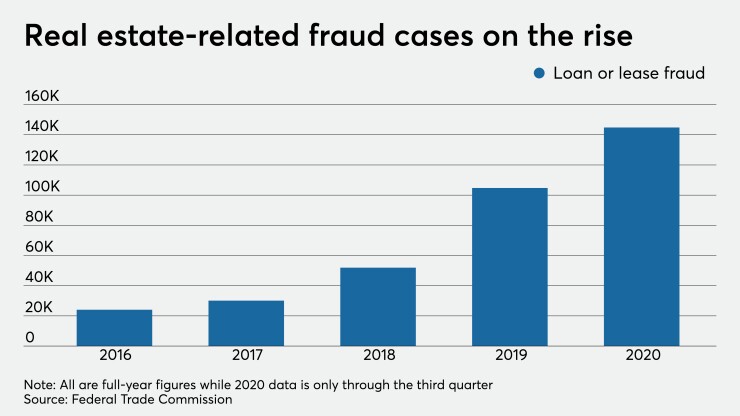

Reported cases of loan and lease fraud attempts have been on the rise in recent years, growing from 24,062 reports in 2016 to 104,758 in 2019, based on data from the Federal Trade Commission. Reports through the first three quarters of 2020 already eclipsed 2019, totaling 144,831. Cases went from 37,693 in the first quarter to 47,700 in the second, to 59,438 in the third. The coronavirus drove this spike as call, text and email scams promising government relief money mounted, according to the FTC.

"The pandemic has demonstrated that fraudsters are very opportunistic and innovative and had been able to adapt and mutate their techniques at a rapid pace, resulting in a considerable increase in fraud," said Selim Aissi, SVP and chief security officer at Ellie Mae, part of ICE Mortgage Technology.

Fraud migrates to places with the weakest coverage. As much as technology can do to validate data and detect threats, prevention starts at the human level. Employees are the gatekeepers, in determining if an application passes the smell test. They can be the best line of defense with the right training. They don't have to become cybersecurity experts, they just have to know to flag something when it doesn’t feel right, said Bridget Berg, principal of fraud solutions at CoreLogic.

"It's not just about documents, it's about the way people interact with you — if they don't pick up their phone, if there's always a rush, even though maybe they got the answers correct," Berg said. "Make sure that people aren't just totally restricted to the boxes, because the fraudsters know what the boxes are."

Fraud in the distressed loan space

Over the last several months, many lenders added efficiencies to keep up with the deluge of volume brought on by record-low interest rates. But repercussions from the pandemic go beyond surging loan applications. Looking ahead, 2021 could come

As moratoriums lift and borrowers exit forbearance plans, a swell in the number of delinquent homes will likely follow. Those pockets of distress generate openings for fraudsters to swoop in to take advantage of desperate situations.

"

Because of staggering unemployment and

Current offerings automate data validation of bank statements while confirming salary and employment using tax ID numbers. While that keeps a chain of custody, tax ID numbers don't cover all employers. Fraudsters use this blind spot to create fake companies.

"Medical or software technology are big ones. It looks like a startup and everyone's making $150K," Berg said. "You can get automated validation of someone's income, but that doesn't serve the smaller employers, so that's where we see that gravitate. Most of the fraud is going to go around the edge of the technology."