Mortgage lender credit standards eased during the second quarter as purchase volume was lower than expected and competition increased.

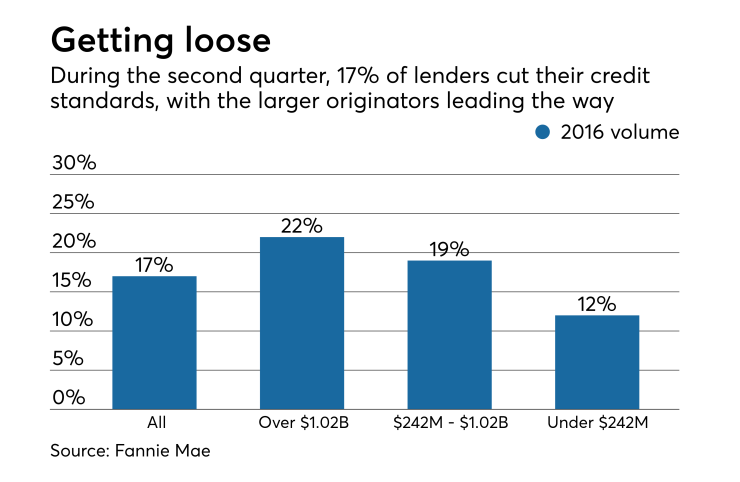

Approximately 17% of lenders eased their standards for loans eligible for sale to the government-sponsored enterprises during the second quarter, up from 13% in the first quarter and 12% for the second quarter of 2016, according to the Fannie Mae Lender Sentiment Survey.

Only 3% of respondents said they tightened their GSE underwriting standards, and the spread of 14% is the highest Fannie Mae has seen in this survey.

"Expectations to ease credit standards climbed to survey highpoints in the second quarter as more lenders reported slowing mortgage demand and increasing concerns about competition from other lenders," said Fannie Mae Chief Economist Doug Duncan in a press release. "Lenders cited additional contributing factors such as diminishing compliance concerns and more support from the GSEs, including

For the second quarter, just 50% of respondents said the demand for GSE-eligible purchase loans increased, compared with 75% in the same period in 2016 and 77% in 2015's second quarter.

There were 16% of the lenders who eased underwriting standards on government loans during the quarter, up from 11% for both the first quarter and 2016's second quarter.

When asked if they expect to reduce credit standards in the next three months, 16% of respondents said yes for GSE loans and 12% for government loans. Just 1% said they expected to tighten GSE credit standards and 2% said they expected to do the same for government loans.

Larger originators, those whose 2016 volume topped $1.02 billion, were the most likely to cut their GSE underwriting standards in the second quarter, at 22%; a similar percentage said they expected to do so in the third quarter.

Among midsized lenders, 19% reduced underwriting standards in the second quarter, with 20% adding they were likely to do over the next three months.

But the smaller lenders, with 2016 volume under $242 million, were the most conservative, with only 12% reducing standards in the second quarter and 7% likely to do so in the third quarter.

Nearly one-quarter of mortgage banks responding to the survey said they reduced credit standards for GSE loans in the second quarter, compared with 11% of depository institutions and 12% of credit unions.

For the same period last year, only 13% of mortgage banks cut credit standards.

Going forward, 23% of mortgage banks expect to reduce credit standards in the third quarter, compared with 12% of depository institutions and 6% of credit unions.