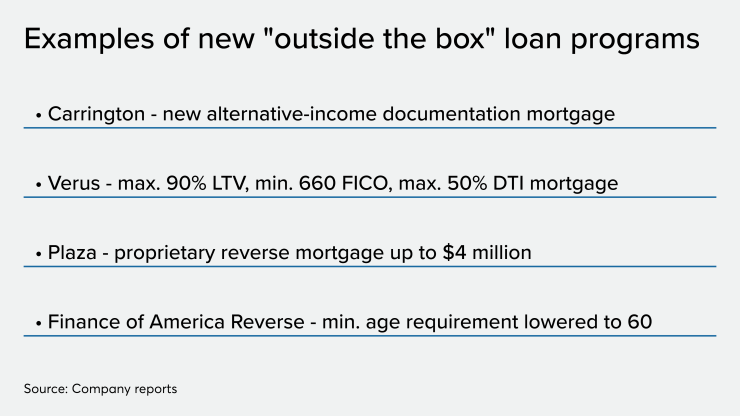

Mortgage lenders are increasingly introducing new loan programs outside of typical underwriting parameters in line with indicators suggesting that the availability of credit in the housing finance market is growing.

For example, Carrington Mortgage Services on Tuesday launched a new nonagency product called Prime Advantage in its third-party and retail loan channels. The alternative-income documentation loan is aimed at serving consumers who "just missed" qualifying for conventional or jumbo loans, according to CMS.

In addition, Verus Mortgage Capital earlier this month introduced a correspondent-channel loan that has underwriting criteria outside the parameters of the Qualified Mortgage safe harbor.

Verus Mortgage Capital's new loan product, Prime Ascent Plus, allows for 12- and 24-month alternative-income documentation for self-employed borrowers, loan-to-value ratios up to 90%, FICO credit scores as low as 660, debt-to-income ratios up to 50% and loan amounts ranging from $150,000 to $2.5 million.

Other examples of expanded credit seen in the last couple months include Plaza Home Loans' introduction of a

The jumbo, conventional and government components of the Mortgage Bankers Association's credit availability index were all elevated in the group’s

The MBA's credit availability index most recent monthly value was 188.9, which is close to the post-crisis high