The Mortgage Bankers Association boosted its 2022 mortgage origination forecast by 1% in December from the previous month, lifting both its outlook for purchase and refinance activity.

While 2021 projections are unchanged from November, they are 2% higher than what the organization's economic forecast released at its

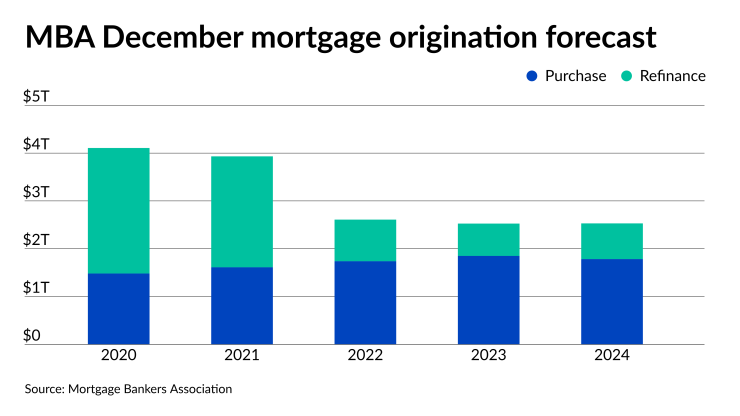

The latest forecast for this year calls for $3.93 trillion in mortgage originations, with 59%, $2.32 trillion, coming from refinancings — the third best year ever after 2020's all-time high of $2.63 trillion — plus a record-high of $1.61 trillion in purchase activity. In October, the MBA predicted $3.85 trillion, with refis totaling $2.26 trillion and purchases $1.59 trillion.

This year's volume would be 4% lower compared with 2020's record $4.1 trillion. The organization is going in a different direction than Fannie Mae,

For 2022, the MBA is now calling for $2.61 trillion in originations, with another record purchase year of $1.74 trillion. But refi activity will drop by over 62% from this year, to $870 billion. The November forecast was for $2.59 trillion for 2022 production, with $1.73 trillion in purchase and $860 billion of refi.

The MBA did not change its 2023 and 2024 forecasts of approximately $2.53 trillion of originations in each year. The organization is forecasting another record year for purchase volume in 2023 of $1.85 trillion.

For next year, the MBA is forecasting that home

Mortgage rates are expected to rise throughout the year and reach 4.0% by December 2022; rates will end this year at 3.1%.

Economic growth is forecast to be 4% in 2022, with the unemployment rate declining to 3.5% by the end of the year, the MBA said.