A new type of home loan is being rolled out by

The turnkey product designed for community banks and credit unions is distinguished by what it calls a "Take-Back" option.

"With [the Take-Back option], you can withdraw the extra money paid over and above your scheduled mortgage payment," said Allen Price, a senior vice president at BSI Financial.

Borrowers must be current on their home loan and cannot withdraw more than one Take-Back at a time.

In addition, there will be a maximum balance determined by the individual financial institution. All Take-Back loans can be repaid anytime during the term of the loan and without penalty.

A

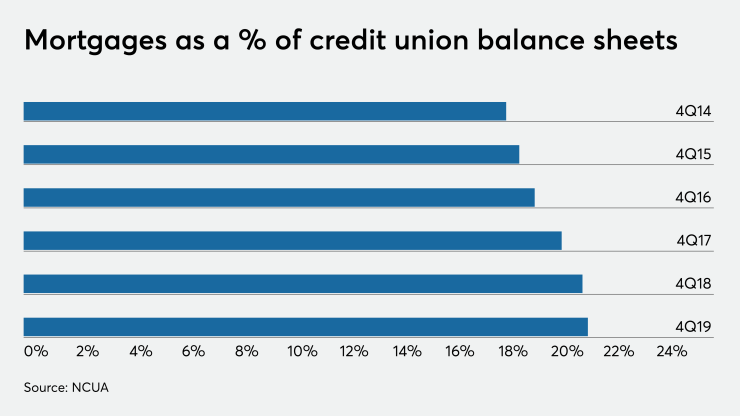

First-lien, fixed-rate mortgages have made up a growing share of the assets on credit union balance sheets, according to the National Credit Union Administration's annual report.

Since the end of 2014, that percentage has grown to 22% from 18%, and

Originations of single-family home loans are currently on track to near or exceed $3 trillion in 2020. The Mortgage Bankers Association estimates single-family originations will approach $3 trillion, and Fannie Mae forecasts that there could be as much at $3.4 trillion in volume. Mortgage originations haven't been this strong since 2003, according to Fannie Mae.