Providing borrowers with an incentive to create financial reserves after closing is a better tool to prevent mortgage loan defaults than measures taken at underwriting, a JPMorgan Chase Institute study declared.

During underwriting, lenders are required to examine the

When it came to DTI, there was little variation based on whether the borrower was above or below the 43% mark at the time of origination. For a loan to

"The income pattern that precedes default was similar for borrowers in both groups, suggesting that it was a loss in income rather than a high payment burden at origination that triggered default," said the report, "Falling behind: Bank data on the role of income and savings in mortgage default," written by Diana Farrell, Kanav Bhagat and Chen Zhao.

"If a high payment burden alone were enough to trigger default, we would expect to see much less of an income shock or no income shock for those borrowers that had total DTI at origination above 43%," the report said.

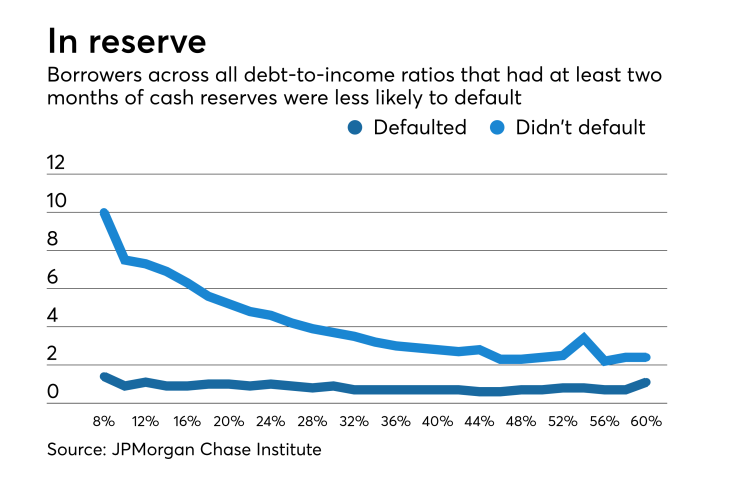

Rather, those borrowers who had larger savings used those to delay going into default when their income declined.

Previously, the researchers found that reducing the loan principal for underwater borrowers was not as effective as providing payment relief

The default rate for those borrowers whose savings could cover less than one payment, 2.54%, was seven times higher than those who had four payments in reserve, 0.36%.

So borrowers should receive incentives —from either or both of the private and public sectors — to build and maintain a reserve fund associated with their mortgage, the researchers said. Any entity that has exposure to default risk from mortgages may want to explore the potential of mitigating it by providing borrowers with that economic incentive.

"Some lenders may want to consider the trade-offs between down payment size and residual cash reserves at origination," the report said. But in the example provided where the borrower can develop reserves because they need less upfront cash (the trade-off is a slightly higher monthly payment), the higher LTV is still 79.8%, which is below the threshold for private mortgage insurance.

The researchers did not look at mortgages where the borrower put less than 20% down, a spokeswoman for JPMorgan Chase said.

Adjustable-rate mortgages, because they change their interest rates and monthly payments, "can serve as a way to help stabilize the economy during a recession," the report said.

In the case of income loss, ARMs can be designed to include a feature that allows borrowers to reduce or defer payments and that would reduce defaults across all business cycles.

"Once armed with an assessment of the

Most of the mortgages in the sample were originated by Chase between 2000 and 2013 and the borrower had a Chase deposit account.