Mortgage market recruiting in 2020 promises to see the focus return to purchase origination professionals – with a twist.

"If you look at the forecast for 2020, we'll probably be doing the same or a little less in overall production as an industry. Certain refinances are likely to fall and that could really put a heightened interest on finding people in the marketplace that are very strong in purchase production," said Paul Buege, president and chief operating officer at Inlanta, a Pewaukee, Wis.-based lender on the 2020 Best Mortgage Companies to Work For list.

Recruiting top purchase-focused production professionals requires a major commitment. Top producers that responded to a National Mortgage News survey last year had been at their companies for more than seven years on average. It's a pattern that speaks to how good a job some employers are doing retaining talent.

"It used to be you just picked up the phone and called recruits. You need to broaden your outreach over time now to be able to find and attract quality originators. They now sometimes prefer text messaging or social media, and you’ve got to be out in front of them at the right time. Our recruiting strategy includes building engagement with quality people," said Patrick Mullen, director of recruiting at Embrace Home Loans, a Middletown, R.I.-based lender on the Best Mortgage Companies list.

Traditional purchase-focused distributed-retail loan officers may be the main recruiting focus for some mortgage companies this year, but the consumer-direct channel also is expected to see some selective growth that will create hiring needs in areas where companies have established, centralized operations.

"Our consumer-direct channel and retail channel will strategically grow next year," said Mullen. "You have certain markets where there are big consumer-direct platforms. I don't know that you'll see a lot of change in that. We already have a platform in a market where we're one of the top consumer-direct lenders, Rhode Island, and we would love to attract more quality employees for it."

Mortgage companies with ties to home construction might be heavier recruiters than other housing finance businesses this year due to their ties to the purchase market.

"Rate fluctuations aren't as impactful to us as some of the retail segments," said Christie Cimring, people operations manager at Taylor Morrison Home Funding, a builder-affiliated lender on the Best Mortgage Companies list based in Maitland, Fla.

Companies use a variety of approaches to recruit, some having to do with operational investments and others with more traditional career development opportunities for their teams. However, they may need to up the ante. Some lenders on the Best Mortgage Companies list are pursuing both.

"There are a lot of technologies and databases that you can gain access to in order to help employees work quicker and faster, but we're making bigger investments in 2020 relative to this whole process of being successful as a company," Buege said. "We are also going to be investing in areas like coaching and leadership because we believe those areas are very, very important. Employees want to be developed. They don't just want to go to a place they know does business well."

Taylor Morrison recently put $1 million into programs and services related to career development, and makes employee-driven investments in digital mortgage technology.

"We encourage our employees to be CEOs of their own careers, and our technology is here to enhance employees' ability to their jobs, not to replace them," Cimring said. "We find that if you treat people well, and there’s a good cultural fit from the start, people stick with you."

Taylor Morrison has gotten as many as 40% of its new hires from referrals in recent years.

Another upside to bringing experienced top producers on board has to do with the reality that, eventually, there will be a generational shift in home purchasing and originators will be looking to bring on new recruits that are at similar stages in their lives.

With that quest for entry-level recruiting in mind, Inlanta has been working to build a sales academy. It's by no means alone. First Heritage Mortgage, an Oakton, Va.-based lender on the Best Mortgage Companies list, has a loan-officer assistant trainee program in which participants are instructed and mentored by top producers.

New entrants are rarely top producers, of course. National Mortgage News' 2019 survey found that the most successful had on average 18 years of experience. With volume trends likely to shift in 2020, the competition for seasoned talent is likely to rise.

"There's still going to be a premium on top sales people. If refinance volumes drop off, that will become more important across the course of the year, so you'll see bidding for those folks take place," said Doug Duncan, chief economist at Fannie Mae.

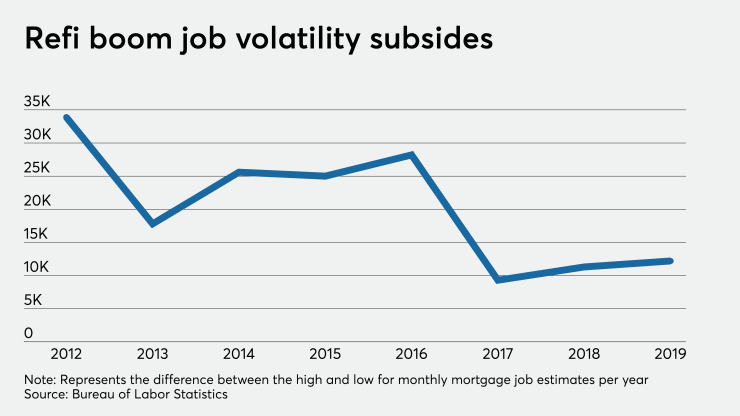

This expectation comes at a time when staffing in the mortgage industry has displayed lower volatility. The difference between the yearly high and low for monthly nonbank mortgage employment estimates generally trended downward since 2012's

"The investment in technology has reduced the volatility of employment. You can actually go back and look at the long-term series of mortgage industry employment, and you will see that, at turning points in the cycle, there used to be a lot more volatility in the number of employees," Duncan said. "What we did see in the last couple of refinance waves is not nearly the up or down we used to see, but much more stable employment, which suggests that businesses have been successful in using technology to convert fixed costs to variable costs."

Duncan did cite one area of employment that might take a step back — or at least sideways — in 2020: positions that support compliance. Again, technology is a big part of the story.

"I think the ramp up in compliance has passed its peak," said Duncan. "They've converted some compliance metrics to be able to be conducted technologically, as opposed to by lawyers. So you've probably seen the peak of employment in that space as the tools have improved."