ICE Mortgage Technology's total fourth-quarter revenue was only $4 million below the year ago period; but its origination segment, the former Ellie Mae, was down by $18 million.

Total revenue was $346 million for the period ended Dec. 31, compared with $366 million

Revenues from origination technology slipped to $231 million for the fourth quarter, versus $245 million quarter-to-quarter and $249 million year-over-year.

Still management at the parent company is bullish on its prospects in the mortgage business.

"With connectivity to nearly every participant in the mortgage industry, we have the opportunity to cross-sell new products like eClose and AIQ to a captive customer base seeking efficiencies," Intercontinental Exchange President Ben Jackson said during the earnings call. "This flywheel effect and the secular trend of electronification give us confidence in our ability to grow this business and capture the $10 billion addressable market."

Partially offsetting the origination decline from the prior year was a $10 million pick up in closing solutions revenue. This rose to $83 million in the most recent period from $73 million in the fourth quarter of 2020. In the third quarter, revenue from this business line was $88 million.

Data and analytics revenue was relatively flat at $18 million in the fourth quarter, compared with $19 million three months prior and $17 million a year ago.

Still, the origination technology business outperformed mortgage-industry

"So we feel great about how the business is executing despite this near-term drop in volumes," Jackson said. "It's hard to predict how long the drop in volumes will play out, but we feel good [about] our ability to grow this business and to outperform the industry backdrop based on our strategy."

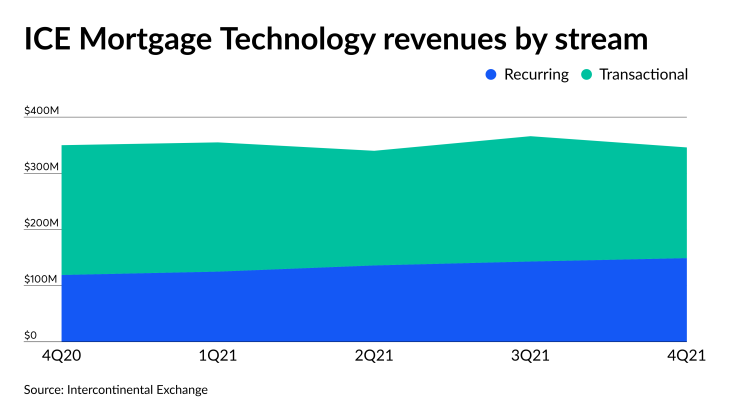

In past calls, ICE management spoke of the need to shift more toward recurring revenue streams and away from more volatile, transactional ones.

For the fourth quarter, recurring revenue grew to $149 million or 43% of the total, from $143 million (39%) in the third quarter and $119 million (34%) in the fourth quarter of 2020. At the same time, transactional revenue fell to $197 million from $223 million and $231 million respectively.

ICE Mortgage Technology's operating income was $86 million, down from $110 million for the third quarter and $113 million one year ago.

On an annual basis, ICE Mortgage Technology had operating income of $397 million in 2021. On a pro forma basis for 2020, which uses an assumption that Intercontinental Exchange owned Ellie Mae, MERS and Simplifile for the full year, operating income was $658 million and in the pre-pandemic year of 2019, it was $238 million.

But the company isn't entirely ruling out a good year in 2022 for transactions that use ICE Mortgage Technology's services, noting that some countercyclical product growth that could lead to future origination gains still exists.

"Home inflation tends to drive people to do