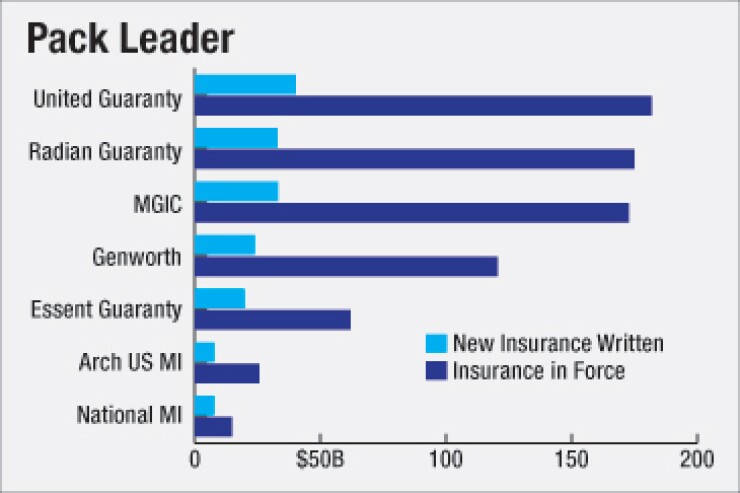

United Guaranty's

With AIG's support, United Guaranty

As a subsidiary of the much larger AIG, United Guaranty has benefited, at least implicitly, from its ability to rely on its parent company as a capital backstop. But even though AIG will still hold more than 80% of United Guaranty's equity after the planned initial public offering, any shift of funds after the spinoff would need to be balanced against the interests of UG's public shareholders, analysts from Fitch Ratings said.

"Once United Guaranty is partially spun off, their dealings with AIG are going to have to be more arm’s-length. They're going to be outside shareholders who will have rights that will need to be respected," said Don Thorpe, Fitch's senior director who covers mortgage insurance.

Capital is important for United Guaranty because it will need to stay in compliance with the Private Mortgage Insurer Eligibility Requirements in order to insure loans sold to Fannie Mae and Freddie Mac. And for lenders, UG's capital level is important because it affects how much new insurance it can write under the

Having more access to capital also means an MI can fully pay any claims; the lack of capital to pay claims is why

United Guaranty has

AIG did not address United Guaranty's capital structure when it announced the spinoff plan, and United Guaranty declined a request for comment. But AIG has tremendous flexibility in the capital structure it creates for a stand-alone United Guaranty, Thorpe said, and officials are likely already developing those plans now, "because it is going to be a lot easier to do that while they still own 100% than it will be once they're only partial owners."

The stand-alone United Guaranty will also be re-evaluated by ratings agencies. The levels of implicit and explicit support AIG will provide to the mortgage insurer following the spinoff — including the potential termination of a capital maintenance agreement — will factor into its new ratings of UG, Moody's Investors Service said in a Jan. 26 report.

Moody's current stand-alone financial strength rating of Baa2 on United Guaranty is raised one notch because of AIG's support. The report also expressed concerns about UG having fewer funding sources, a higher cost of capital, and higher reporting and compliance expenses as a public company.

However, it expects that United Guaranty "will remain a leading mortgage insurer, with AIG providing reinsurance protection for a transition period, or arranging for substitutes, to ensure that UG complies with capital standards of Fannie Mae and Freddie Mae."

Activist investor Carl Icahn has

There's not much history of mergers and acquisitions in the PMI industry. And the ultimate valuation of the spun-off United Guaranty will likely affect any possible M&A deal, said Fitch managing director Jim Auden.

Radian Group was

Old Republic International Corp.'s

But in January of 2014, Arch Capital Group, previously a reinsurer for private MIs,