Mortgage companies have historically done a lot of griping about the cost of leads when they need them, but now that they don’t, they may be available at a bargain.

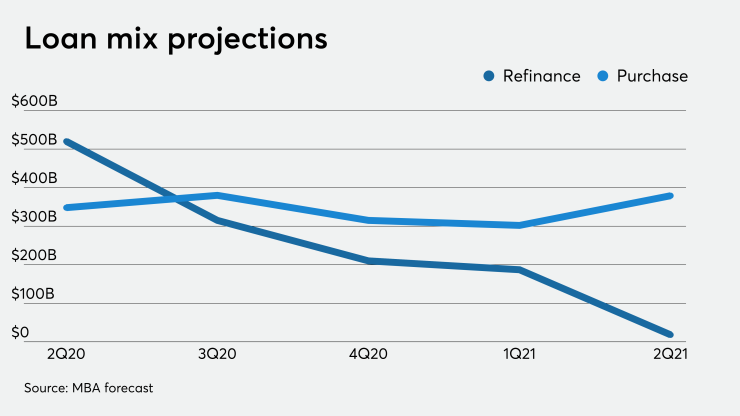

Certain types of purchase leads could come in handy down the road. While refinancing interest is high now, the Mortgage Bankers Association's forecast suggests it will gradually recede over the next 12 months, increasing the importance of purchase lending.

"There are some forward-thinking lenders who will say, 'I'll do my refis but I'm going to make sure to maintain capacity for my purchases,'" said Garth Graham, a senior partner at the Stratmor Group. "If you were strategic and had some intestinal fortitude, you might buy some preapproval-style long-term purchase leads now while they are less costly, knowing they might convert in the future."

Marketing costs per loan for direct-to-consumer lenders have been declining in each of the last two years as rates have fallen and refinancing has increased, said Graham.

The average marketing cost per loan was roughly $1,750 in 2018. By midway through 2019, it had fallen to $850. It’s even lower now, albeit not as low as when the coronavirus first spread.

More recent marketing costs can only be estimated because the metric is a lagging indicator typically delayed by at least 60-90 days that pass between the expenditure and the funded unit, but Graham thinks the cost for direct lenders trying to acquire new customers will drop by another 50% if trends are maintained to less than $500 per loan.

"That would be the lowest for this segment since Stratmor began tracking this data," he said.

When mortgage rates initially plummeted during the pandemic, multiple market participants observed an unprecedented drop in lead prices.

"If you were on those sites, you saw that lender demand practically evaporated," said Mike Eshelman, head of consumer finance at Jornaya.

Some of that demand has come back and prices have rebounded a bit, he said. But there still may be bargains out there for companies that have the wherewithal to monitor and convert leads, particularly when rates fall.

"It's something that people should keep an eye on," said Eshelman.

Lead aggregators have been the quickest to offer discounts, said Eshelman. Online real estate sites like Zillow, Trulia, or Realtor.com may be slower to, said Rick Sharga, president and CEO of CJ Patrick Co.

"There could be some fire sale pricing going on now, but that wouldn't be the usual course," he said.

Zillow, which also owns Trullia, indicated that it will be flexible with its pricing in some circumstances.

"We regularly evaluate and adjust our pricing as market conditions and demand warrants. Doing so allows us to offer competitive rates to advertisers while also ensuring consumers that come to our site have a variety of options available to them," Zillow said in an emailed statement.

Some mortgage executives agreed that there are still some bargains in lead pricing amid the ongoing refi boom.

"There was an unusual drop in prices," said Glenn Brunker, the head of Ally Home, a direct-to-consumer lender and bank, referring to the period when the coronavirus first became a widespread concern in the United States. "Purchase leads are still worth buying in that environment, but they’re dependent on conversion."

As an online bank, the value of a converted purchase-mortgage lead to Ally may be multiplied by the number of other financial services that customer may also be interested in. Ally "dabbles" in purchase-lead buying to this end, Brunker said.

Automating lead management

While it may be challenging to free up enough resources to manage long-term leads at a time when mortgage companies can barely keep up with current demand, it's a task that can be automated, Graham said.

Eshelman, too, advises clients to use technology that monitors behavioral data and sends out an alert when that data signals a consumer is ready to buy.

Lender SRE Mortgage Alliance, which is also selectively buying low-cost purchase leads, offers an automated funding process aimed in part at freeing up brokers' time up so they can focus on business-development work like lead conversion, chief marketing officer John Stevens said.

"During a refi boom, the cost of leads go down and it's bad business to simply stop buying them because you're too busy," said Stevens. "I guarantee you that your client isn't too busy."