The market for non-qualified mortgages has been robust thus far in 2019, offering a pragmatic option for otherwise viable borrowers, as long as lenders stay vigilant about pushing the envelope too far.

Difficult market conditions in the early part of 2019 caused credit standards to loosen and

"The upside is a lot of people who can't qualify traditionally — especially in the economy today where we have a lot more self-employed — that just can't show the type of income they need to show on traditional tax returns and they don't need the ability to repay with the two years," Kevin Parra, CEO of Plaza Home Mortgage, said in an interview. In the beginning of April, Plaza expanded its non-QM program to better serve more nontraditional borrowers.

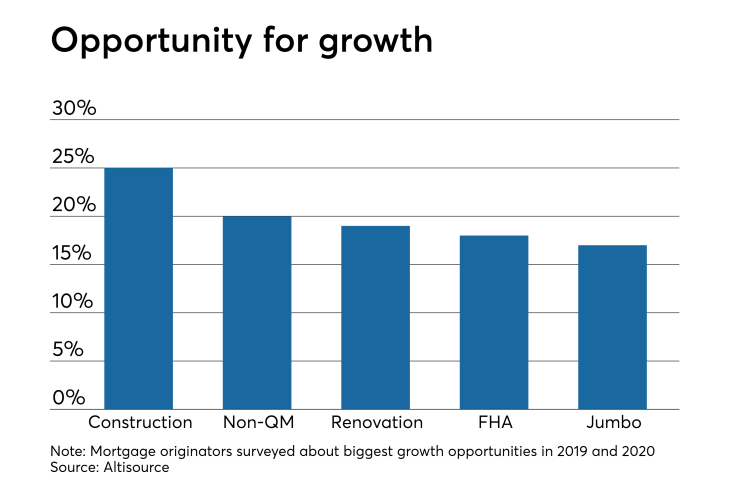

A quarter of originators view non-QM as an opportunity for growth through 2020, according to a survey by Altisource.

While the 400% figure is slightly misleading since it represents a small piece of the overall market, anything with exponential growth will attract investors. Non-QM lending today is safer and more viable than it was during the prehousing bubble of yesteryear and shouldn't be looked at like subprime 2.0.

"We're not doing riskier loans every six months to fuel growth," Tom Hutchens, senior vice president of sales and marketing at Angel Oak Mortgage Solutions, said in an interview. "It's not a guideline expansion or a matter of lowering standards. We make tweaks to our guidelines occasionally, just because we see certain credit profiles we like and we're OK with doing them. But we're not chasing the fringes to grow the business."

All of Angel Oak's mortgage volume falls under non-QM and is responsible for a quarter of 2019's total issuance. At the end of January, the lender

Borrowers still need

"Fannie Mae has a very tight, narrow box and there's no wavering. All credit decisions are made by a computer, you either fit it or you don't, there's no in between. With non-QM, we manually underwrite every loan," Hutchens said.

However, that doesn't mean it comes without caution or obstacles.

Manual underwriting allows pliability opposed to the rigidity of the

"There's an underwriter running through the files and actually putting together all the pieces rather than the no-income or the stated-income were mostly automated," Jon Gerretsen, president of Trelix, said in an interview. "Manual underwriting is also another barrier to acceptance because a lot of the lenders now don't have that in-house because the industry moved to an automated underwriting environment."

The human touch through manual underwriting also opens mortgage decisions to judgment. Lenders should still heed restraint when making a decision.

"A downside potentially could be in the subprime area of non-QM. The fear is not proving ability to repay. You're really opening yourself up for potential litigation," said Parra. "It's funny when there's profitability and people start forgetting stuff like that. That's the downside, it gets carried away in the race to the bottom as far as what they're willing to take because of the money."