The latest iteration of American Mortgage Network began originating loans in 2020, but the rate-driven wave of loan applications left the company at an inflection point.

Seeking to keep loans moving through the underwriting process, while trying to fill its back office staff out during a period when every lender was hiring for that kind of talent, the Chula Vista, Calif.-based lender did one other thing.

"We've kind of managed through this by not growing the sales staff. I've haven't recruited a loan officer in nine months," CEO and President Joseph S. Restivo said in mid-December. "I've wanted to, but I have to make sure our turn times stay good."

Some would argue against that approach. While companies may not be hiring because they are too busy or not busy enough, they also can't afford to stop recruiting, said Bill Cosgrove, owner and CEO of Union Home Mortgage.

“We think it's a scale game and you've got to be continually growing and looking for talent," he said, adding that approximately 85% of the Strongsville, Ohio-based company’s recruiting efforts are focused on cultivating internal candidates.

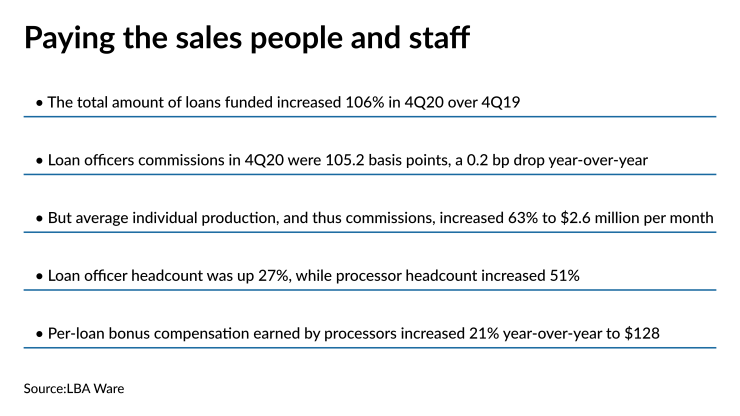

Processor headcount increased 51% year-over-year in 2020, but that didn't keep up with the workload. These staffers had to handle 99% more loan files in the fourth quarter compared with one year prior, said Lori Brewer, the CEO of LBA Ware, a provider of incentive compensation management technology for the mortgage industry.

As a result, the back office is drowning under the record loan volume, Brewer said.

Loan officers are "able to take on more volume because in my opinion they have more technology that's been invested in on their behalf," Brewer said.

In fact, the loan officer headcount only increased 27% on a year-over-year basis. LBA Ware's sample came from about 100 companies that had been on its system during both periods. At the end of 2020, the retail sales staff at those firms totaled approximately 10,000 people. At the same time, those companies had 3,700 processors, up approximately 50% from the prior year.

So even with additional hires, the processors, underwriters and closers are swamped "because there are still so many manual processes on the back end."

Many companies have paused on planned staff expansion because they are too busy, and feel that they don't have the time to recruit, said Eric Levin, executive vice president of client development at Model Match, which provides metrics to help companies develop strategies around the hiring process. Lenders often don't believe they have the time to build and develop a number of relationships on a weekly and monthly basis, he said.

But recruiting is an ongoing process, and having that base in place helps at a time when companies are staffing up due to high application activity.

However, 2021's volume, while still strong for purchases,

Emphasizing the back office

Loan officers aren’t the only staffers that may be targeted by rival recruitment efforts; sales people cannot be successful unless there are the support staffers — the processors, underwriters and closers — that move the loan through the pipeline, and there is a shortage of experienced people on this side of the table as well.

There are reports of huge hiring incentives for back office workers, in addition to the usual bonuses, Brewer said. But even so, those gains in compensation do not equal the additional payments loan officers are taking home

While a loan officer's base rate didn't increase in the fourth quarter (it stayed at 105 basis points on a

But the per-loan bonus compensation earned by processors increased by just 21% to $128 per loan in the fourth quarter, compared with $106 in the same period in 2019. That translated to an average production bonus of $2,503 per month for the fourth quarter, up from $1,569 one year prior.

Still, experienced underwriters right now have an advantage in getting a larger salary because of the transitory need. "It's not like you can train them overnight, [by hiring] someone out of college, so they're in demand," Brewer said.

With the health crisis and the resulting economic crisis, there's been "a strange shaped recovery, in that we've got a lot of unemployed people, but they don't have the right skill set," said Debora Aydelotte, the chief operating officer of Promontory MortgagePath, which provides fulfilment services.

The mortgage industry has combed as many people as it could out of the marketplace that had the skill set, she said. So now lenders are hiring people that don't know as much about the business to fill processor and underwriter positions, teaching them on the job, she said.

Promontory MortgagePath is starting a training program to get those people — either recent college grads or those that worked in other areas of financial services — up to speed on the mortgage business.

The differentiator between lenders will be the training, Cosgrove said; how effective these firms are at turning inexperienced new hires into really good mortgage professionals within six to 18 months.

"That is where I think the game is going to be won and lost in the future and that's something you cannot stop and start," Cosgrove said. "You can't decide that this year we're going to be effective at bringing new people into the industry and we're going to be successful at that, and then next year not so much."

Promontory MortgagePath's target market is generally community banks. As a group they have gotten out of mortgage, "so we're helping them get back into it," said Aydelotte. "They don't always have the knowledge base, so they look to us to bring their mortgage fulfillment on board." The company is booked through April and into May for new client onboarding.

"The challenge and opportunity in recruiting is to find really great operations professionals," Cosgrove said. "It's just as great as is for loan officer professionals."

To Brewer, the question is, how can

Pay cuts prohibited

Even with job reductions, lenders will have to continue to pay the high salaries they are offering right now. to keep the most productive back office staffers.

"You cannot decrease their compensation, once you go up, you're stuck" said Brewer. "The only thing you can do is hire someone new at a lower comp rate and then phase them out."

But that strategy is likely to make a poor impression on some employees. "You can't call somebody up and say 'I know I've been paying you $140,000, I need to start paying you $100,000 now.' That doesn't go over too well. So it's going to be hellish," she continued.

Companies can try to align their compensation structure with their profitability, but that comes with its own concerns, Brewer said.

It needs to be explained in a clear and concise manner because "the worst is to have somebody not understand how they're getting paid."

Promontory MortgagePath has had to adjust where it is getting its workers from, in addition to adjusting its salary bands.

Working remotely has allowed it to go into second-tier, third-tier areas that might have a good base of employees to work with. "They have the knowledge, but since they're not in a big city, there's less competition," Aydelotte said. "So it is much easier for us to bring those folks on board."

AmNet is a 100% employee-owned company with ties to a military family support organization,

For Union Home, it is not other mortgage companies that it is recruiting against, Cosgrove said.

"Today, more and more, companies are competing against the universe of employers," he said. "So as an employer, you're becoming more worldly in how you approach the strategy of acquiring wonderful talent all throughout your organization."