While last year’s CARES Act directed lenders of government-related loans to take certain actions in the face of the pandemic, the

"They don't necessarily have to develop new programs, for those private paper loans, but if it's going to be sitting there untouched with no path forward, perhaps the mutually beneficial approach would be to find some alternative whether it be a modification or deferral or something to keep the income source coming in," explained Jonathan Kolodziej, an attorney and banking and financial services partner at Bradley Arant Boult Cummings.

While forbearance plans — and then deadline extensions — for conforming and government loans had been spelled out in federal legislation, for the non-qualified mortgage and private-label market, the time frames and methods varied widely.

"Some non-agency forbearance programs were as short as three to six months," said Vadim Verkhoglyad, head of quality assurance and co-head of research and publication at dv01. "The impairment rate in

While impairments for non-QM borrowers increased 40 basis points month-over-month in February to 11.1%, this was still well below the 19.2% seen at the peak last June, dv01 reported.

When addressing a forbearance exit, lenders most often capitalized the missed payments and converted them into a deferred, non-amortizing balance (which typically does not accrue additional interest), often required

"Most commonly, the borrower's payment is unchanged post exit from forbearance" on these non-QM loans, Verkhoglyad said.

"The ability to treat missed payments as a balloon amount and have borrowers return to normal payment should be a big help — as would continued macro-economic improvements," Verkhoglyad said. "Giving servicers options to explore loss mitigation is already a standard post-Great Financial Crisis practice for most in the industry."

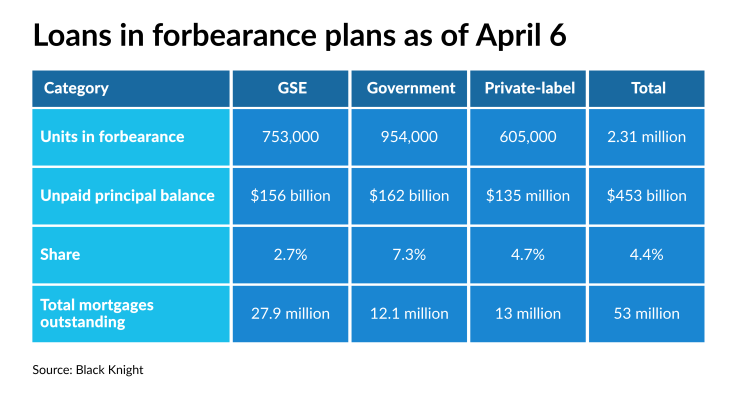

There were 2.3 million mortgages in an active forbearance plan

Federal Housing Administration and Veterans Affairs mortgages made up 954,000 of that total, with Fannie Mae and Freddie Mac at 753,000 and the private-label/portfolio segment at 605,000. The prior week, there were 1.05 million FHA/VA loans, 822,000 Fannie/Freddie loans and 670,000 PLS/portfolio mortgages in a plan.

The private label clients at subservicer BSI Financial have all enacted programs very consistent with the CARES Act and so they're highly motivated to keep loans performing, and get borrowers back on track through deferment programs, modifications and other things along those lines, said company president John Lawrence.

"If it is in a securitization, they have default triggers that they have to worry about," Lawrence said. "So everyone at the end of the day is pretty aligned in getting customers back on track that have been impacted with COVID."

There's been a lot of consistency among the deferment programs in forbearance.

Still, on the private label side "there's a little bit more customization that's needed from us from a client perspective, but it's just working through with them," Lawrence said.

But the legal risks to the private-label and portfolio servicers would be the same as for those that service the government-backed loans, explained Kolodziej, as "they're going to just be subject to the federal law. It's really a wide umbrella so I think everybody kind of gets brought under the same framework which ultimately results in the same level of risk for nearly everyone."

However, servicers will have a tricky task in dealing with the potential of many months of escrow shortages that built up because payments weren't being made, said Carissa Robb, the president and chief operating officer at Constant.AI, a fintech that specializes in providing loss mitigation services.

In normal circumstances, escrow shortages are spread out over the following 12 months. Replenishing those funds will lead to increased payments for borrowers.

So as a result, servicers "certainly will have a population that needs a little more help, as they expire,” said Robb. “That breathing room, I think, is where the CFPB is going with the proposed moratorium on avoidable foreclosures."

At BSI Financial, approximately 3% of its 140,000 loan portfolio is in active forbearance plans, down from about 4%-to-5% at the peak. A significant number of borrowers at BSI received forbearance without ever missing a payment.

In general, "when you look

It’s too early to tell if that wave of foreclosures that many consider to be the driving factor for the CFPB's proposal will in fact arrive, Lawrence said.

"We'll know a lot more in the next few months as we talk to customers about their situation, but I'm not in the camp that sees a huge wave at this point in time on my portfolio," he added.

To avoid any problems, Robb said, servicers need to step back and look at doing the right thing by the borrower.

"The right thing to do is say we gave you a reprieve, and now we're going to reset the delinquency and allow you to show that you have this renewed ability and willingness to repay, either with your regular payment, or through a modification," said Robb. "So that's where the pause [helps] — if somebody is violating that basic concept of fair treatment, the moratorium on the ability to file a foreclosure is not actually going to address that."